Hi, Wondering if anyone has some guidance on getting volume for index symbols? The only index I found it to work for so far is $INDU, but I'm not sure what volume that is as it doesn't match $TVOL. I assume its for the constituent stocks but I was hoping someone knows for sure.

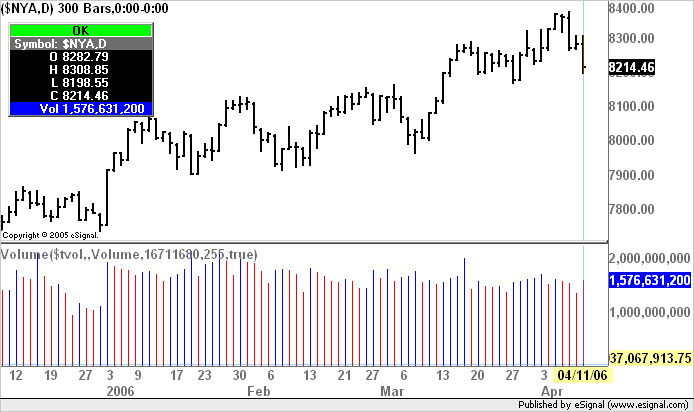

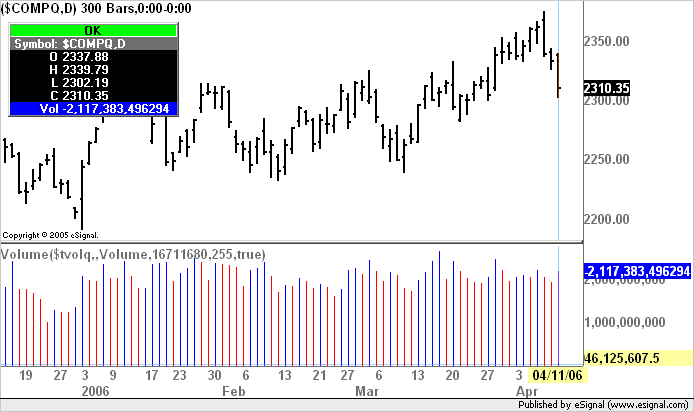

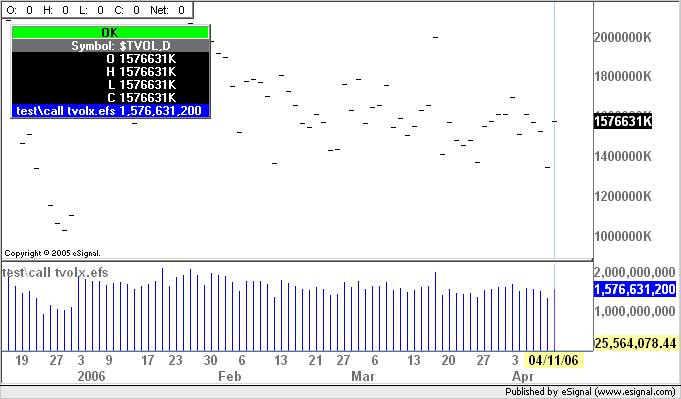

I would like to be able to calculate studies using volume on the NYSE & NASDAQ but $NYA & COMPQ do not work. The efs's I've found also won't work if $TVOL is used as an override synmbol. So I am at a loss currently.

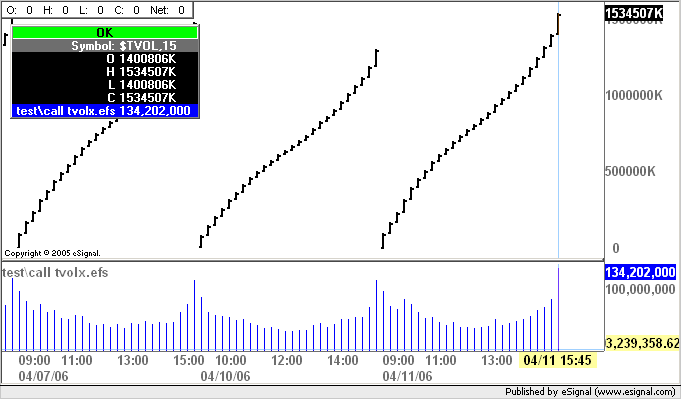

Do I need to special code an efs to use $TVOL or is there some other way to do this?

THanks!

Jonathan

I would like to be able to calculate studies using volume on the NYSE & NASDAQ but $NYA & COMPQ do not work. The efs's I've found also won't work if $TVOL is used as an override synmbol. So I am at a loss currently.

Do I need to special code an efs to use $TVOL or is there some other way to do this?

THanks!

Jonathan

Comment