Re: Smoothed Moving Average

Inside that code is how WILDER'S SMOOTHS!!

Originally posted by Jharvey407

Yes buzz, I did see that.

I am not sure what your point is though, as I have stated repeatedly, I am looking for the formula for the

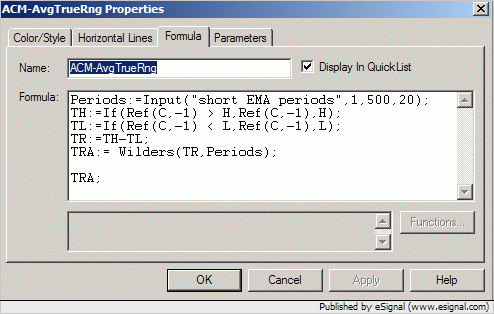

Smoothed Moving Average

and what you have directed me too is a smoothed RSI.

Yes buzz, I did see that.

I am not sure what your point is though, as I have stated repeatedly, I am looking for the formula for the

Smoothed Moving Average

and what you have directed me too is a smoothed RSI.

Comment