This situation is my problem:

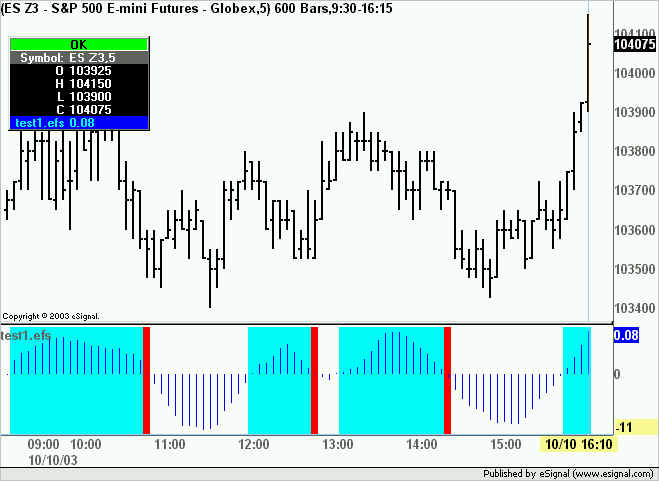

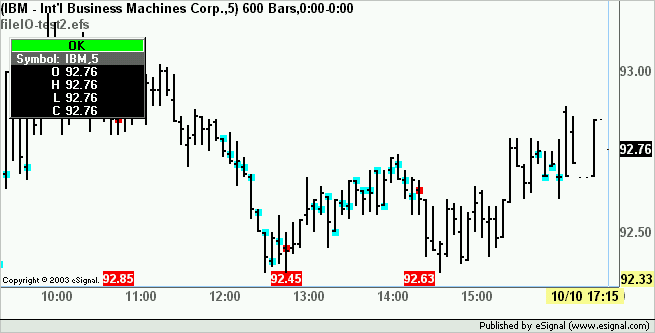

I have three charts of the same instrument but in three different intervals: 60, 15 and 1 minute. On each I have formula which gives me the signal to buy or sell. Ofcourse mostly these formulas give me different signals but sometimes all of them are the same. for example all three formulas give me signal to buy. What I want to do is to write the formula which will give me a signal to buy or sell only if all three signals from the charts will be the same (all three will give signal to buy or sell). Its very important to me because I would like to automatickly test this kind of formula. Maybe there is other way to do it. I dont have clue how to do it.

Please help me.

thank you.

I have three charts of the same instrument but in three different intervals: 60, 15 and 1 minute. On each I have formula which gives me the signal to buy or sell. Ofcourse mostly these formulas give me different signals but sometimes all of them are the same. for example all three formulas give me signal to buy. What I want to do is to write the formula which will give me a signal to buy or sell only if all three signals from the charts will be the same (all three will give signal to buy or sell). Its very important to me because I would like to automatickly test this kind of formula. Maybe there is other way to do it. I dont have clue how to do it.

Please help me.

thank you.

Comment