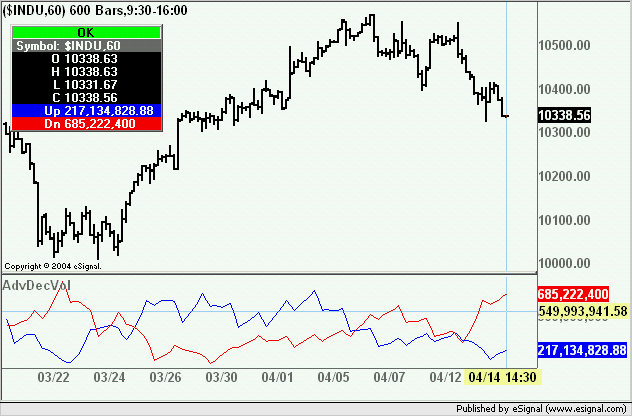

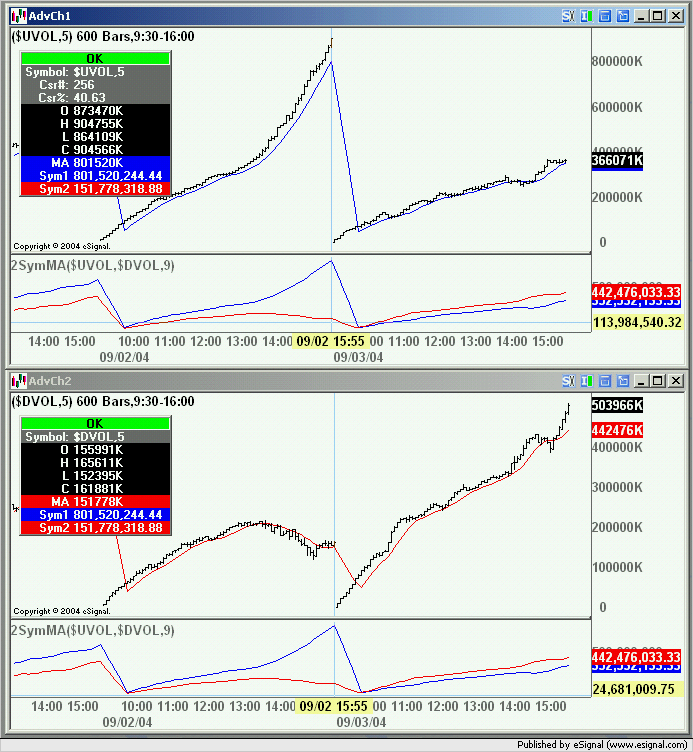

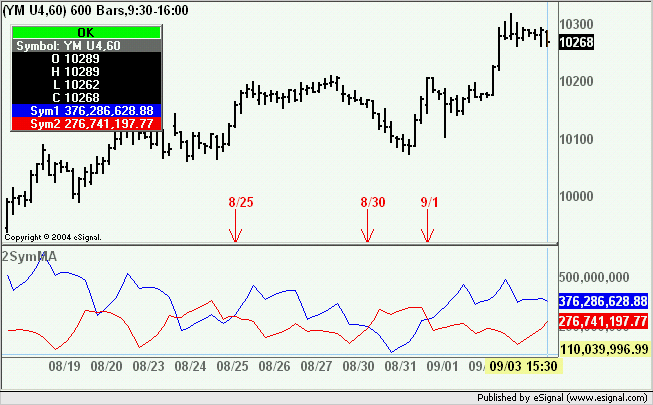

Is it perhaps possible to develop a study with two moving averages on the volume of advancing and declining issues that appears more or less like the MACD. Meaning it can be charted without having to open a chart of the $ADV OR $DECL'S

For example :

input (lenght of moving average) for Advancing issues volume.

input (lenght of moving average) for Declining issues volume.

On your lower chart you have then two moving averages say one red the other blue for the volume of $adv and the other $ decl isues.

Will it be possible to enter a symbol so that the study can work on Nasdaq $advq and dvolq also.

Thank you very much in advance.

For example :

input (lenght of moving average) for Advancing issues volume.

input (lenght of moving average) for Declining issues volume.

On your lower chart you have then two moving averages say one red the other blue for the volume of $adv and the other $ decl isues.

Will it be possible to enter a symbol so that the study can work on Nasdaq $advq and dvolq also.

Thank you very much in advance.

Comment