Hi guys,

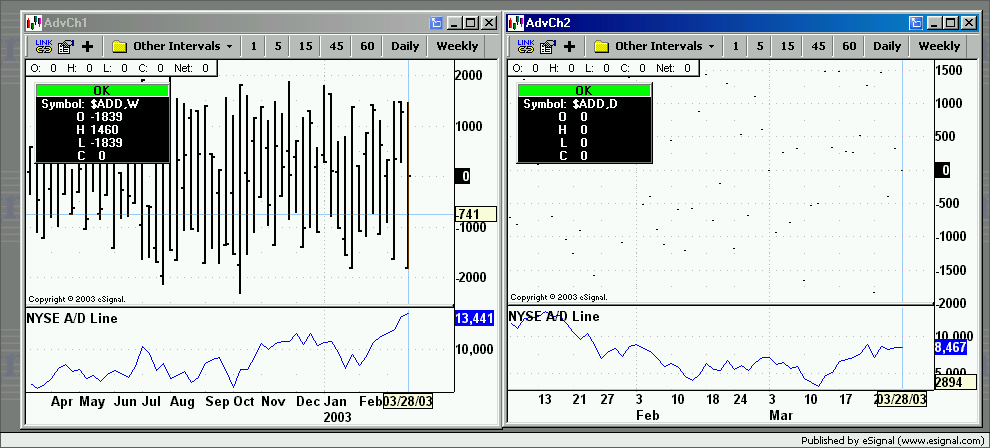

Is there a way to chart an intra-day advance decline line and put/ call ratio? I'd like to bring these up on an advanced chart if possible.

Thanks,

-pk

Is there a way to chart an intra-day advance decline line and put/ call ratio? I'd like to bring these up on an advanced chart if possible.

Thanks,

-pk

Comment