beta v7.7 build 653

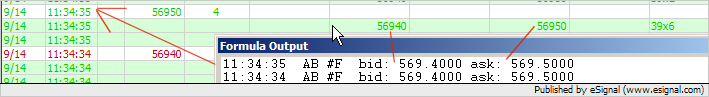

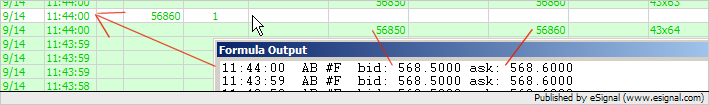

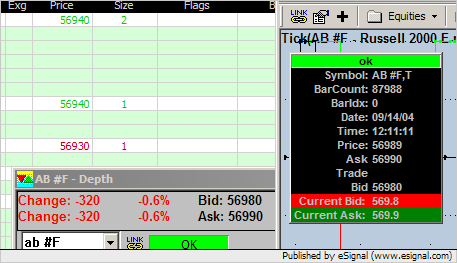

I get both bid and ask values sporadically set to ZERO. How should I interpret this?

See this output in xml format with a couple of samples.

Data from AB #F on Globex

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.6</price><bid>529.4</bid><ask>0</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.6</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>true</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>0</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.1</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>0</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>529.1</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529</price><bid>529</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>529</bid><ask>529.1</ask></tick>

I get both bid and ask values sporadically set to ZERO. How should I interpret this?

See this output in xml format with a couple of samples.

Data from AB #F on Globex

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.6</price><bid>529.4</bid><ask>0</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.6</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>false</bar><price>529.5</price><bid>529.5</bid><ask>529.6</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.4</bid><ask>529.5</ask></tick>

Log: <tick><bar>true</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>0</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.1</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>0</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.4</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.3</price><bid>529.3</bid><ask>529.4</ask></tick>

Log: <tick><bar>false</bar><price>529.2</price><bid>529.2</bid><ask>529.3</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>529.1</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529</price><bid>529</bid><ask>529.2</ask></tick>

Log: <tick><bar>false</bar><price>529.1</price><bid>529</bid><ask>529.1</ask></tick>

Comment