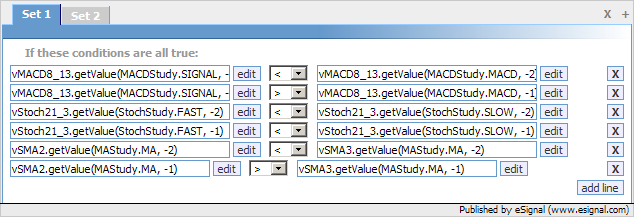

I was wondering if anyone could help me with an EFS that shows when i have a MACD, Stochastic, and 3DMA cross up. I already have the if statements in but I'm looking for signal to only happen when all 3 cross on the same day. I need an If MACD cross up && Stoch cross up && 3DMA cross up and then an If all the crosses are on the same day then give the buy signal. I used the formula wizard and came up with this code but it gives a buy signal everytime all three indicators are up instead of just when the indicators cross.

Thanks,

Coheirs

Thanks,

Coheirs

Comment