Hi

1. I lost money by having a trade that was not prompted by any obvious signal.

- On 7/26/05, Russell 2000 emini (esignal symbol AB), 8 minutes chart, I was long from a signal at 13:04:02 (price > MA(15) + 0.2). I had a Stop Loss of 2.

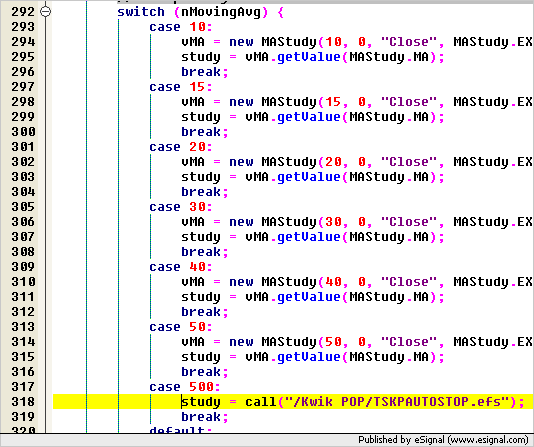

The system is continuously in the market depending on price being above/below MA(20).

At Stop Loss being hit, when I have 1 contract only, the system re-enters according to the price position relative to MA(20).

- At 13:39:47, in the middle of a big up candle, I got a Sell trade and I went Short. When I should have kept going long.

This is quite frightening because I do not know the cause.

This happened more than once but yesterday it was a big loser.

I suspect maybe the Internet connection went down temporarily and when it came back the first signal was short for some reason? I didn’t watch my PC while trading.

2. What happens when the connection with eSignal comes down in the middle of efs running? It starts from scratch, i.e. the globals are initialized etc. ?

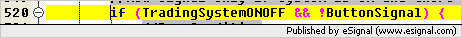

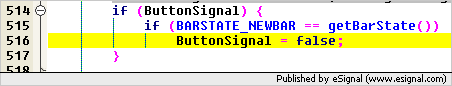

3. I have a Button ‘System OFF’ (see function ONOFFButton() in my code) to start running my efs, so can an Internet disconnect/reconnect restart my efs?

In Backtesting, this short signal didn’t occur, obviously.

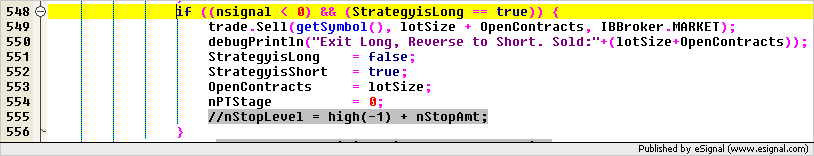

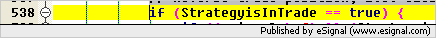

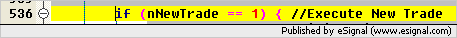

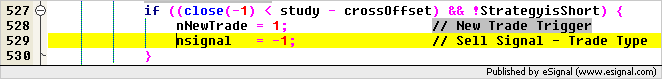

Can anybody, please, have a look at my code and maybe give me a hint?

Please see attached file.

Thanks a lot

Arie

1. I lost money by having a trade that was not prompted by any obvious signal.

- On 7/26/05, Russell 2000 emini (esignal symbol AB), 8 minutes chart, I was long from a signal at 13:04:02 (price > MA(15) + 0.2). I had a Stop Loss of 2.

The system is continuously in the market depending on price being above/below MA(20).

At Stop Loss being hit, when I have 1 contract only, the system re-enters according to the price position relative to MA(20).

- At 13:39:47, in the middle of a big up candle, I got a Sell trade and I went Short. When I should have kept going long.

This is quite frightening because I do not know the cause.

This happened more than once but yesterday it was a big loser.

I suspect maybe the Internet connection went down temporarily and when it came back the first signal was short for some reason? I didn’t watch my PC while trading.

2. What happens when the connection with eSignal comes down in the middle of efs running? It starts from scratch, i.e. the globals are initialized etc. ?

3. I have a Button ‘System OFF’ (see function ONOFFButton() in my code) to start running my efs, so can an Internet disconnect/reconnect restart my efs?

In Backtesting, this short signal didn’t occur, obviously.

Can anybody, please, have a look at my code and maybe give me a hint?

Please see attached file.

Thanks a lot

Arie

Comment