I'm fairly new to EFS2. I'm trying to create an alert based on two criteria (just for purposes of learning):

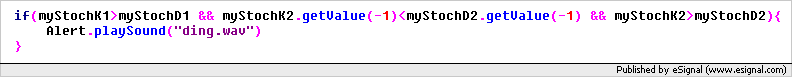

A simple hourly stochastic must be rising (K above D);

A 10 min stochastic must show a cross of K above D.

In other words, the hourly stochastic act as a longer-term trend indicator, and the 10 minute as the long 'alert signal'. Again, this is merely for learning.

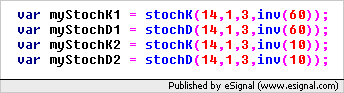

I've tried to program this using the EFS editor and declaring two instances of the built in Stochastic study, then attempting to specify the interval desired. No luck. I then created two custom stochastics, harcoding the hourly (60) and ten (10) intervals, then creating a new instance of each stochastic in the alert. No success.

What happened in the first case was that my first rule (K crosses above D on the ten) was recognized and used, but the 60 min rule of 'K greater than D' was ignored. In the second case, I merely received several syntax errors.

Is there a way to specify interval on the same indicator type (stochastic) for two or more instances within one formula, and to require the alert to return a 'true' condition for more than one interval on the stochastic?

Thanks for any insights!

A simple hourly stochastic must be rising (K above D);

A 10 min stochastic must show a cross of K above D.

In other words, the hourly stochastic act as a longer-term trend indicator, and the 10 minute as the long 'alert signal'. Again, this is merely for learning.

I've tried to program this using the EFS editor and declaring two instances of the built in Stochastic study, then attempting to specify the interval desired. No luck. I then created two custom stochastics, harcoding the hourly (60) and ten (10) intervals, then creating a new instance of each stochastic in the alert. No success.

What happened in the first case was that my first rule (K crosses above D on the ten) was recognized and used, but the 60 min rule of 'K greater than D' was ignored. In the second case, I merely received several syntax errors.

Is there a way to specify interval on the same indicator type (stochastic) for two or more instances within one formula, and to require the alert to return a 'true' condition for more than one interval on the stochastic?

Thanks for any insights!

Comment