Hi,

I am at my wits end trying to figure this out. I am having trouble creating a custom series and then applying a technical analysis study to it.

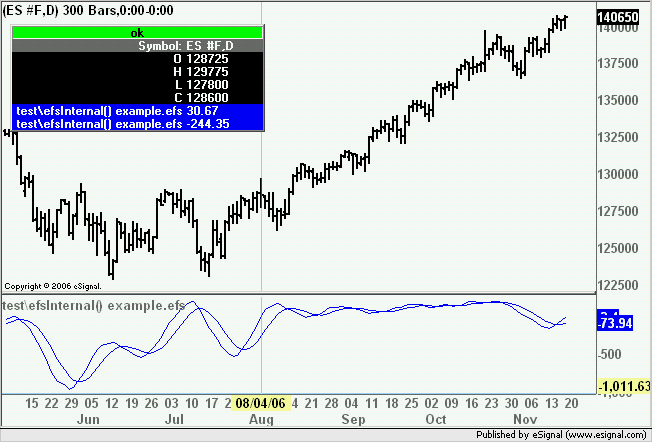

In the attached efs, I am trying to calculate 2 ROC series using different calculation periods (one 11 days, the other 14 days), add them together, and then create a weighted MA of the sum. There are no errors from the code when loading on to a chart, but nothing is plotted.

I must be missing something simple...

Any and all help appreciated,

Jonathan

I am at my wits end trying to figure this out. I am having trouble creating a custom series and then applying a technical analysis study to it.

In the attached efs, I am trying to calculate 2 ROC series using different calculation periods (one 11 days, the other 14 days), add them together, and then create a weighted MA of the sum. There are no errors from the code when loading on to a chart, but nothing is plotted.

I must be missing something simple...

Any and all help appreciated,

Jonathan

Comment