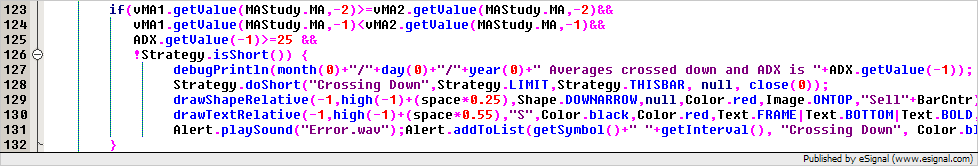

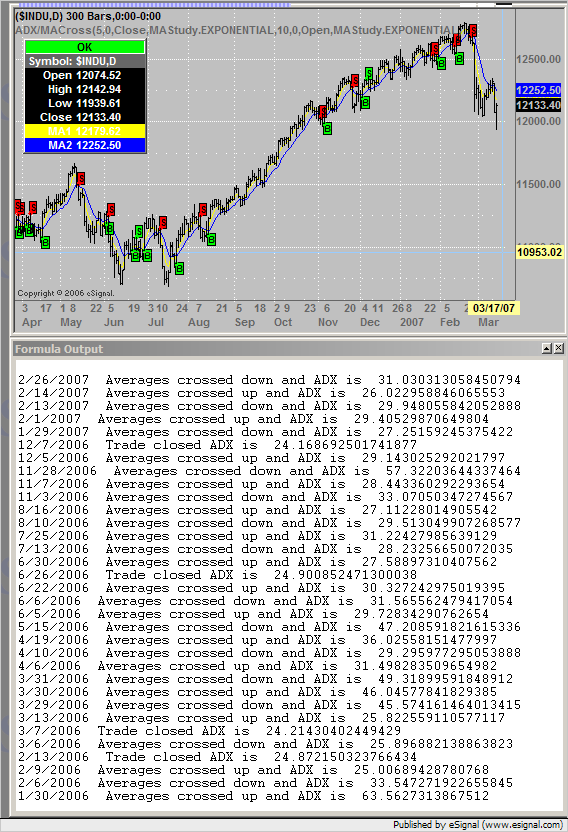

Please...is there anyone out there that can help with my formula. I have d-loaded a simple MA crossover and tweeked it a bit to suit my needs but I can't get it to update real time. I understand that it should update even when minimized but it will not. I know there are tons of posts on this subject but I an new to e-signal and definately new to programming and if someone could just point me to the appropriate thread I would really appreciate it.

Much Thanks,

Tony

Much Thanks,

Tony

Comment