Hello!

Prompt please:

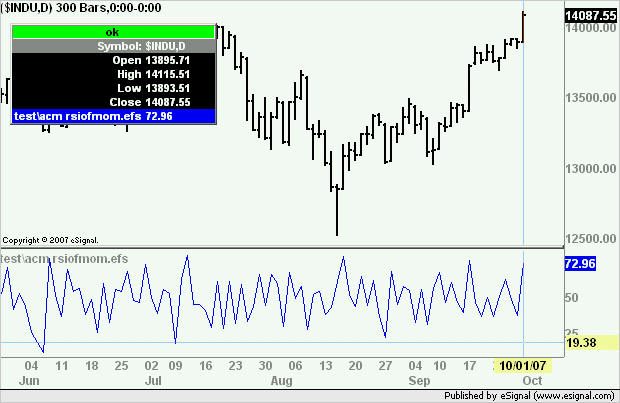

It is necessary RSI (3) from close today - close yesterday.

As I understand here it is necessary to write something. (A picture has attached)

In advance thanks!

Prompt please:

It is necessary RSI (3) from close today - close yesterday.

As I understand here it is necessary to write something. (A picture has attached)

In advance thanks!

Comment