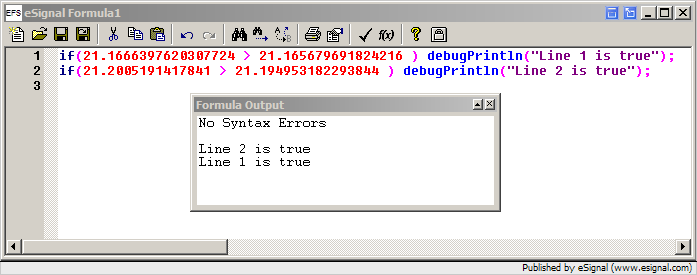

In one test script, the same routine and same if statement evaluates the following differently. The statement is:

if (xMA1.getValue(0)>xMA1.getValue(-1) ...

Here are the values for each of the respective variables above. The if logical evaluation of each is shown in parens.

21.1666397620307724 21.165679691824216 (true)

21.2005191417841 21.194953182293844 (false)

Both of these should evaluate as "true." Right?

There are no other overriding statements that would affect the logical evaluation.

Bob

if (xMA1.getValue(0)>xMA1.getValue(-1) ...

Here are the values for each of the respective variables above. The if logical evaluation of each is shown in parens.

21.1666397620307724 21.165679691824216 (true)

21.2005191417841 21.194953182293844 (false)

Both of these should evaluate as "true." Right?

There are no other overriding statements that would affect the logical evaluation.

Bob

Comment