Hello!

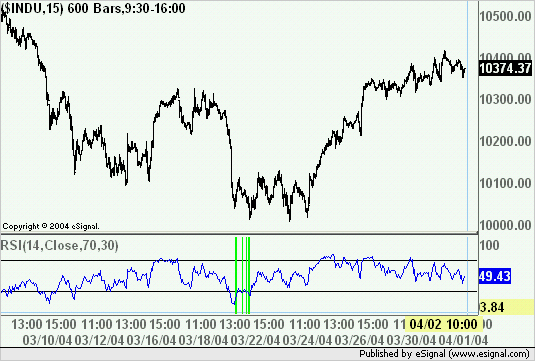

I have this RSI trading system which I want to combine with an additional trading signal. This signal should be a simple 200-period moving average as a filter. The criterion is the slope of the 200-period moving average, either rising or falling (current value of ma minus prior value of ma divided by prior value times 100). For example a buy signal should be created if RSI is below 30 (oversold) AND the slope of 200-period moving average is rising.

I would be really happy if someone could write an EFS-study which has the slope filter in it so that I can adapt it to my RSI study.

Thanks ahead!

Regards,

Simontrader

I have this RSI trading system which I want to combine with an additional trading signal. This signal should be a simple 200-period moving average as a filter. The criterion is the slope of the 200-period moving average, either rising or falling (current value of ma minus prior value of ma divided by prior value times 100). For example a buy signal should be created if RSI is below 30 (oversold) AND the slope of 200-period moving average is rising.

I would be really happy if someone could write an EFS-study which has the slope filter in it so that I can adapt it to my RSI study.

Thanks ahead!

Regards,

Simontrader

Comment