I have an EFS study with both a MACD and Stochastic in it. I am trying to show both studies in a merged fashion.

I can do this MANUALLY by adding both studies to the chart, then merging them.

My problem is:

Only the last one shows.

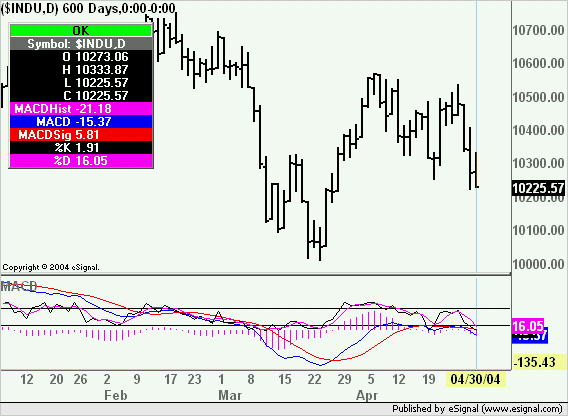

This shows the MACD only:

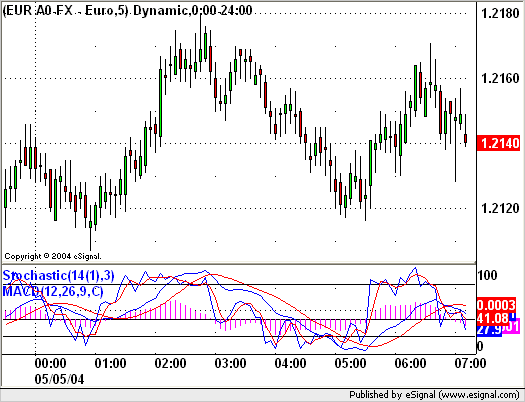

This shows the Stochastic only:

hmmm.

There must be a trick to it?

Thanks,

Ted.

-function THEO( Get'nFancyWithThemTharIndicatorThingys )

I can do this MANUALLY by adding both studies to the chart, then merging them.

My problem is:

Only the last one shows.

This shows the MACD only:

PHP Code:

return new Array (

vMACD1.getValue(MACDStudy.HIST),

vMACD1.getValue(MACDStudy.MACD),

vMACD1.getValue(MACDStudy.SIGNAL)

//vSto1.getValue(StochStudy.FAST),

//vSto1.getValue(StochStudy.SLOW)

);

PHP Code:

return new Array (

vMACD1.getValue(MACDStudy.HIST),

vMACD1.getValue(MACDStudy.MACD),

vMACD1.getValue(MACDStudy.SIGNAL),

vSto1.getValue(StochStudy.FAST),

vSto1.getValue(StochStudy.SLOW)

);

There must be a trick to it?

Thanks,

Ted.

-function THEO( Get'nFancyWithThemTharIndicatorThingys )

Comment