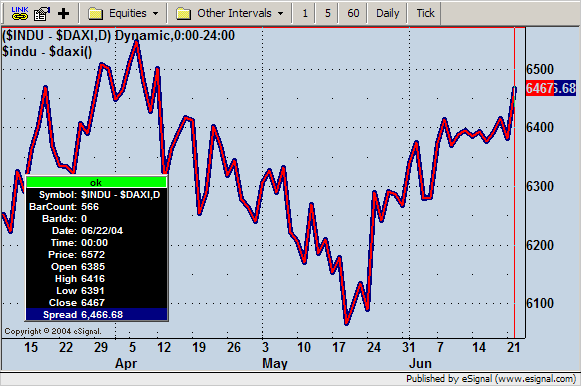

when using advanced charts to chart the difference between two indexes say the dow & dax you would use the following code $indu - $daxi , now on the daily bars this uses the close of the dow & the dax on say 18/06/2004,

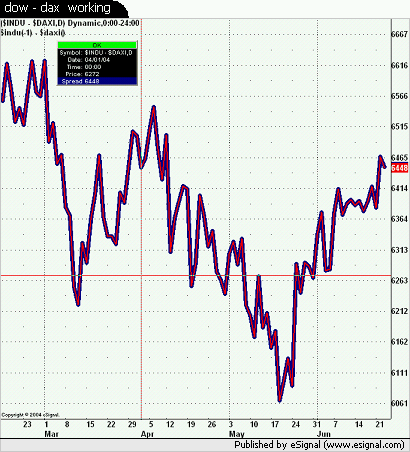

is there any way of plotting this using the previous nights close on the dow & todays close on the dax, i have tried the following but it does not work,

$indu(-1) - $daxi

anyone got any ideas,

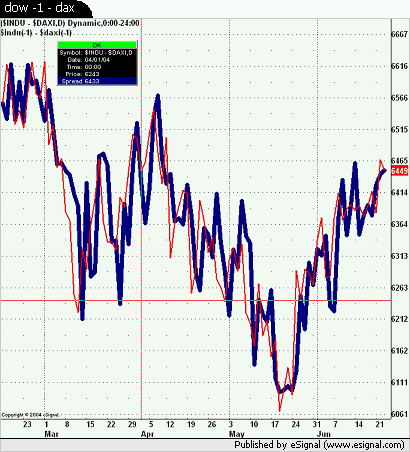

is there any way of plotting this using the previous nights close on the dow & todays close on the dax, i have tried the following but it does not work,

$indu(-1) - $daxi

anyone got any ideas,

Comment