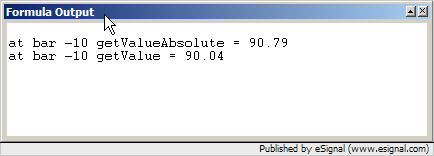

I'm looking to use the getValueAbsolute function, but I think my understanding of the function itself needs a little help.

In the EFS function reference the funtion is listed as follows: getValueAbsolute( barType [, nOffset] [, nNumBars] [,Symbol] )

However, in many of the formulas that I have seen written the funtion is used as follows: vH = getValueAbsolute("High", vIndex, vSymbol); with vIndex as follows vIndex = getFirstBarIndexOfDay(vAbsTime, vSymbol);

In the above usage it is clear that the bartype matches up to the "high", but the vIndex variable and the vSymbol dont seem to clearly match up. The symbol would appear to match the vSymbol variable, but I'm missing the connection between the offset / numbars portion of the formula and the vIndex variable. I would like to use this function and need help bridging the gap in my understanding. Thank you in advance for any help.

In the EFS function reference the funtion is listed as follows: getValueAbsolute( barType [, nOffset] [, nNumBars] [,Symbol] )

However, in many of the formulas that I have seen written the funtion is used as follows: vH = getValueAbsolute("High", vIndex, vSymbol); with vIndex as follows vIndex = getFirstBarIndexOfDay(vAbsTime, vSymbol);

In the above usage it is clear that the bartype matches up to the "high", but the vIndex variable and the vSymbol dont seem to clearly match up. The symbol would appear to match the vSymbol variable, but I'm missing the connection between the offset / numbars portion of the formula and the vIndex variable. I would like to use this function and need help bridging the gap in my understanding. Thank you in advance for any help.

,

,

Comment