Marcus

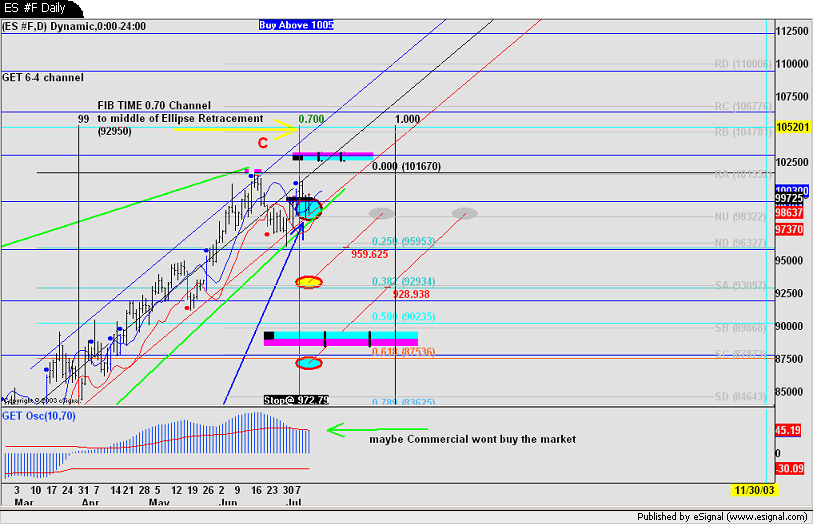

ES in the middle of 6/4 , testing TJ WEB NU, testing 99725 T&P, C completed.........All wrong to take the boots and the ski and get ready?

Better safe than sorry , right , but seems like we are just on the limit of the border....1 inch and than ?

Thanks for your comments

(maybe it is all wrong)

Fabrzio

Comment