Mitch

Welcome, first.

Impossible to answer you questions completely: so just a "brush" and then a couple of suggestions.

A) Advanced Get is a proprietary software conceived by Tom Joseph. lately the company Trading Techniques merged with ESIGNAL group of comapanies allowing to thge AGET customers the Enormous power and tools array of ESIGNAL PLATFORM 7.4 Gold.

CLICK HERE to have a number of videos tutorials to better understand what is the software structure of ESIGNAL AND AGET.

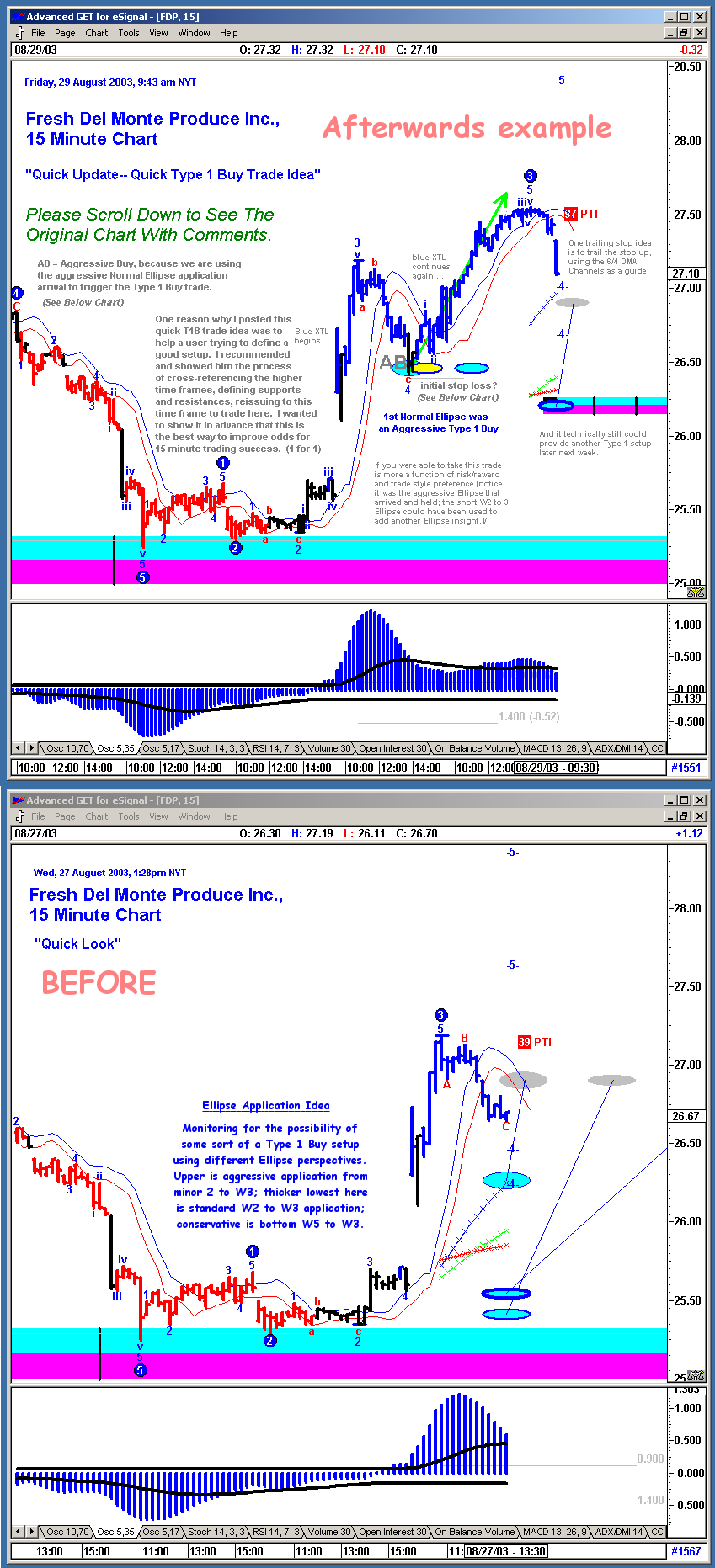

AGET ( Acr. for ADVANCED GET) Is a ELLIOT based SOFTWARE with many others propietary features .

B) the numbers you see are the counting of the 12345 and ABC waves price movements, according to the ELLIOT ORTHODOX PRICE MODEL .

Nevertheless AGET is made for TRADERS , so lets you USE the whole theory either in RT or EOD for trading , profitable purposes.

As you see there is some walls for a complete answer here t0o your questions:

- The fact that you should at least know superficially Elliot

- The fact that you should have ESIGNAL ADVANCED GET Software.

Nevertheless if you want to get deeper in the Knowledge of Both ELLIOT and how does AGET works you may join MARCUS R. ADVANCED GET GROUP HERE and tyou'll have a thoroughfull answer to ALL your questions.

I let you note that you have the chanche of a 30 days free trial of the ESIGNAL PACKAGE, so that you can see if suits- as I am sure- to your needs and trading style.

Cordially

Welcome, first.

Impossible to answer you questions completely: so just a "brush" and then a couple of suggestions.

A) Advanced Get is a proprietary software conceived by Tom Joseph. lately the company Trading Techniques merged with ESIGNAL group of comapanies allowing to thge AGET customers the Enormous power and tools array of ESIGNAL PLATFORM 7.4 Gold.

CLICK HERE to have a number of videos tutorials to better understand what is the software structure of ESIGNAL AND AGET.

AGET ( Acr. for ADVANCED GET) Is a ELLIOT based SOFTWARE with many others propietary features .

B) the numbers you see are the counting of the 12345 and ABC waves price movements, according to the ELLIOT ORTHODOX PRICE MODEL .

Nevertheless AGET is made for TRADERS , so lets you USE the whole theory either in RT or EOD for trading , profitable purposes.

As you see there is some walls for a complete answer here t0o your questions:

- The fact that you should at least know superficially Elliot

- The fact that you should have ESIGNAL ADVANCED GET Software.

Nevertheless if you want to get deeper in the Knowledge of Both ELLIOT and how does AGET works you may join MARCUS R. ADVANCED GET GROUP HERE and tyou'll have a thoroughfull answer to ALL your questions.

I let you note that you have the chanche of a 30 days free trial of the ESIGNAL PACKAGE, so that you can see if suits- as I am sure- to your needs and trading style.

Cordially

Comment