I am going to try and stop posting here for a while, so if others would like to step forward and help here, it would be appreciated. Thanks, marc

Announcement

Collapse

No announcement yet.

Interesting Chart Patterns To Monitor In Coming Days...

Collapse

X

-

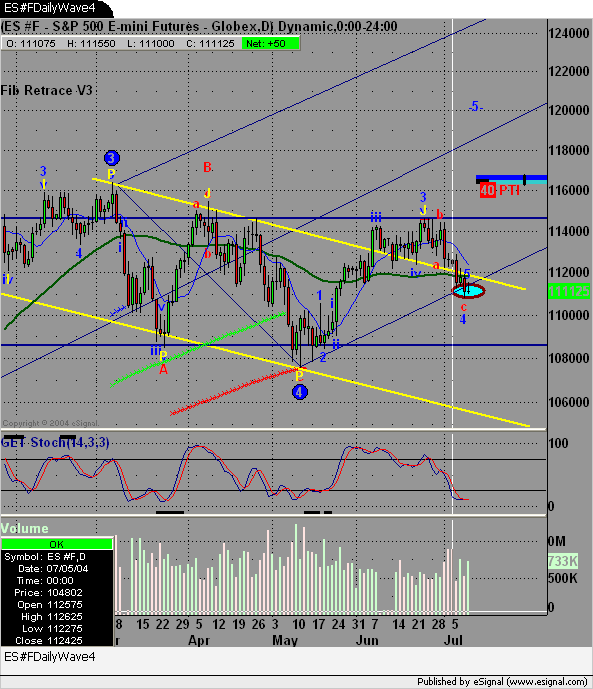

Garth, you are right... a PTI of 34 is almost as good as a PTI of 35.... plus or minus a few points is not going to kill you with the PTI. But as the PTI further derogates to a lower value it serves as more of a warning there may be something else going on in this profit-taking sequence than meets the eye. There is then higher risk associated with a Type 1 setup, and that needs to be factored into any trade idea.

Originally posted by gspiker

Duane,

No comment on the ellipse, but you bring up an interesting subject with the PTI comment.

My understanding (which may be flawed) is that 35 is a threashold number, and it really doesn't matter if it is 0, or 34 you are just plain more unlikely that the wave 5 will complete if it is under 35.

Now given that the PTI can and will change...it may well be that a 34 is more likley to turn to greater than 35 than a 22 is...

So, anyone care to comment on these two ideas? Is a PTI of 34 "almost" as good as a 35 and much better than a 22?

Is a 34 more likely to be able to turn to a 35 than say a 22?

GarthMarc

Comment

-

I just wanted to add that I am only taking a 2-3 week break is all. I just need to focus really hard on the markets right now is all... plus taking a little vacation in a couple weeks. Will be laying low until then, is all. Hoping others can help keep this thread going until then is all I really meant.

Originally posted by MR I am going to try and stop posting here for a while, so if others would like to step forward and help here, it would be appreciated. Thanks, marcMarc

Comment

-

Let's play a game

I am sure everyone is sorry to hear about Marc’s hiatus (I sure am). I’ve had an idea on a way to kill time until his return. Specifically, let’s play a game. If enough people are interested, we could get crakin’ as the saying goes. Here’s my proposal.

As we all know, the markets have been stuck in a trading range for several months. Presently, I’m in the camp that the major indices are forming a bull flag, which could might portend upside action in the months to come. That view might well prove to be very wrong, and even if it is eventually correct, there may be some major downside action in the weeks ahead (for example, I hate the sentiment numbers - last week the American Association of Independent Investors (AAII) were still very bullish this week even as the market slid. I think that’s got to come down big time before there’s a possibility of a rally).

That said, if the bull flag is the correct call (which is a * big * if), perhaps it’s time to make a list of some stocks that have the potential to rally when and if the breakout occurs. Now I know most everyone on this thread uses AGET scans to select buys and sells. My proposal is to use a scan I developed which is based upon an accumulation-distribution oscillator to select potential buys, then use AGET to analyze those selections in depth (sort of a back asswards approach). This scan is in the very rudimentary development stages, and the selections probably will prove to be highly erroneous. In other words, this exercise will be strictly for educational purposes only, and is not to be considered as a recommendation for buying certain stocks.

If there’s enough interest, I’ll post some scan selections and my AGET analysis on one or two issues, time permitting (I’m a bit busy now with work, so it could be sketchy). I would only ask that other board members participate in their AGET analysis. This idea will not have legs unless members of this board participate in the analyzing these selections. Let me here your thoughts.

Regards,

Jim M

Comment

-

Hi Jim,

I think this is an excellent idea. I believe by promoting some positive discussion regarding general market direction, it will have a two-fold effect.

1. Educating traders about Elliott Wave theory and analysis.

2. Highlighting some of the features and tools of Advanced Get that have not been discussed in detail on the forums.

I'll contribute to this forum as well.... I’m looking forward to reading the thoughts and ideas of all the traders who want to take part in this!

Comment

Comment