Dean,Matt, Philippe:

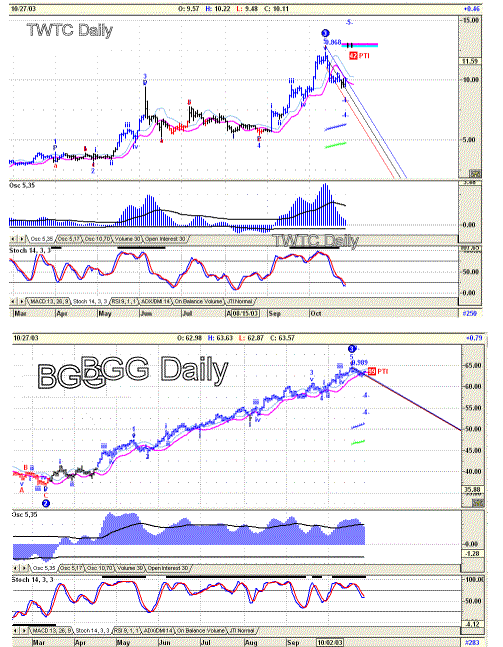

I recently acquired Advanced GET EOD and have not yet turned on the data stream. However, I’m experimenting with the program using TC2000 as the data source. I’m going to set up the scans you guys used and see what results I get. I note that the results you obtained differed to some degree. Do all three of you use real-time GET?. If not, do you use GET EOD with the eSignal data feed? Anyway, you get the idea – what’s causing the discrepancy in your scans?

I recently acquired Advanced GET EOD and have not yet turned on the data stream. However, I’m experimenting with the program using TC2000 as the data source. I’m going to set up the scans you guys used and see what results I get. I note that the results you obtained differed to some degree. Do all three of you use real-time GET?. If not, do you use GET EOD with the eSignal data feed? Anyway, you get the idea – what’s causing the discrepancy in your scans?

Comment