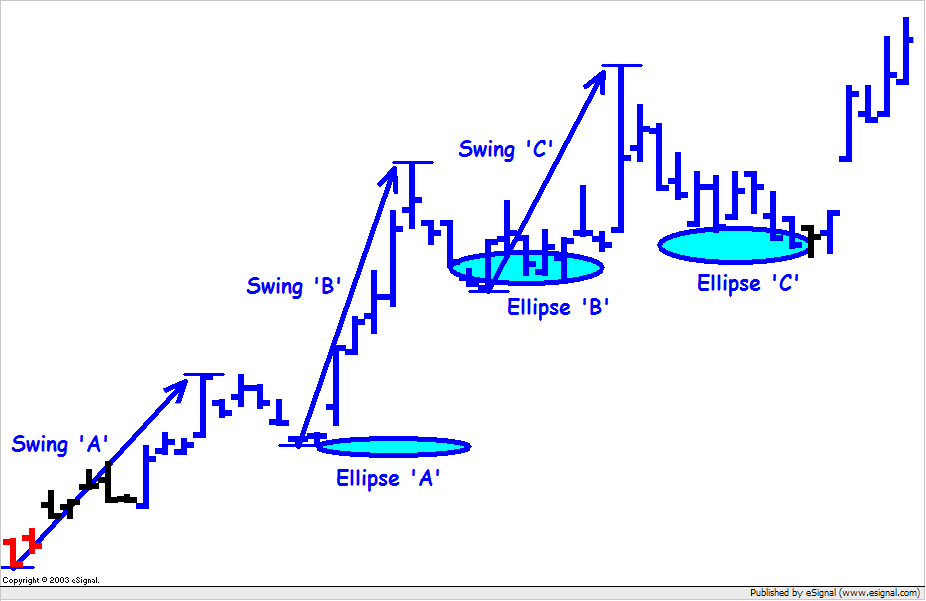

When is the appropriate time to use the Ellipse tool?

I have run into many examples, in stocks and commodities, like the following:

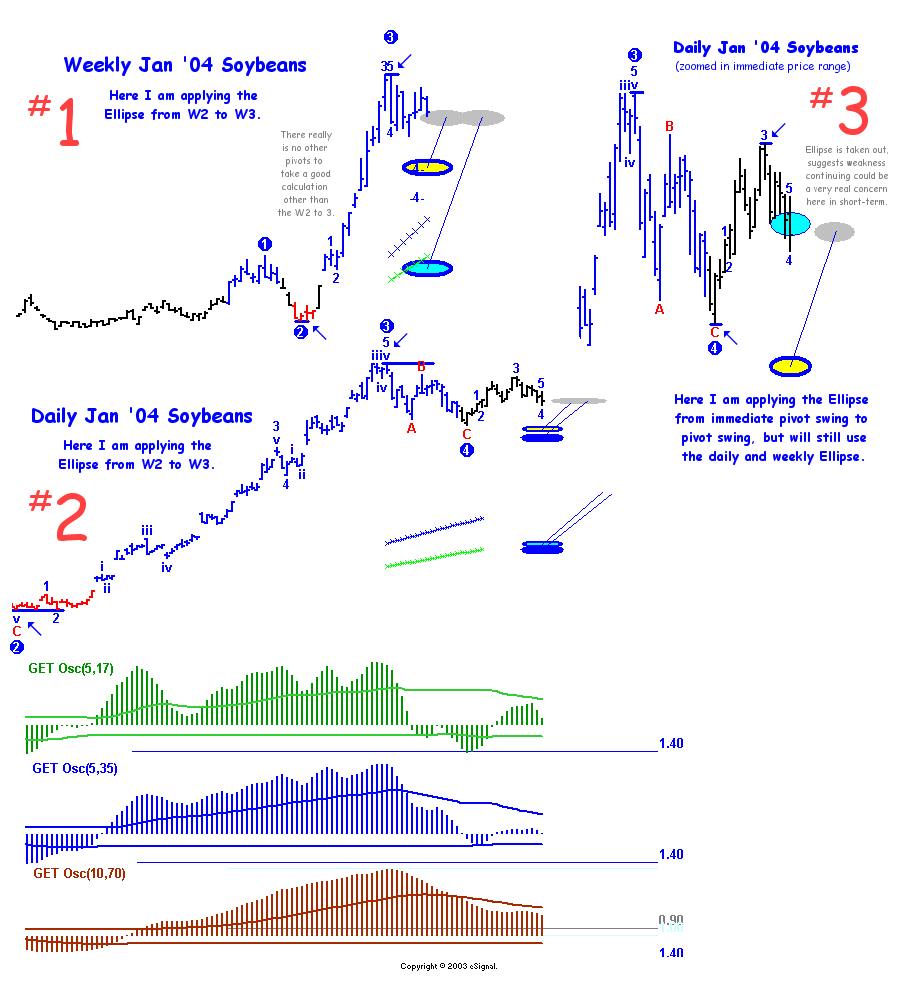

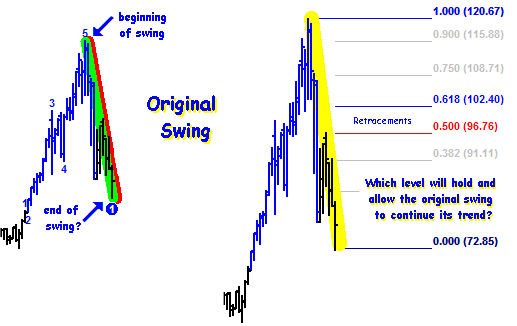

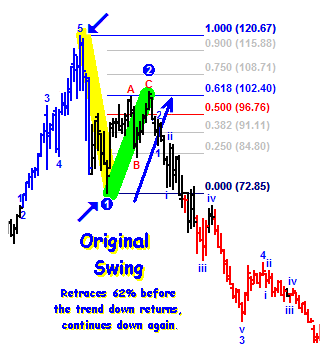

Using the Original Elliott count, both January Soybeans and Soybean Meal show waves 3 and 4 completed and a move toward wave 5 highs.

However, if I switch over to the Alternate 2 - Short-term Elliott wave count, it shows that each wave 3 has not completed five waves up yet.

Do I wait until the short-term count labels five waves in wave 3 before applying the Ellipse tool?

I am going to assume that when the short-term count shows five completed waves in wave 3, then the original Elliott wave count will be relabeled with a new wave 3 high, or possibly an ABC.

I have run into many examples, in stocks and commodities, like the following:

Using the Original Elliott count, both January Soybeans and Soybean Meal show waves 3 and 4 completed and a move toward wave 5 highs.

However, if I switch over to the Alternate 2 - Short-term Elliott wave count, it shows that each wave 3 has not completed five waves up yet.

Do I wait until the short-term count labels five waves in wave 3 before applying the Ellipse tool?

I am going to assume that when the short-term count shows five completed waves in wave 3, then the original Elliott wave count will be relabeled with a new wave 3 high, or possibly an ABC.

Comment