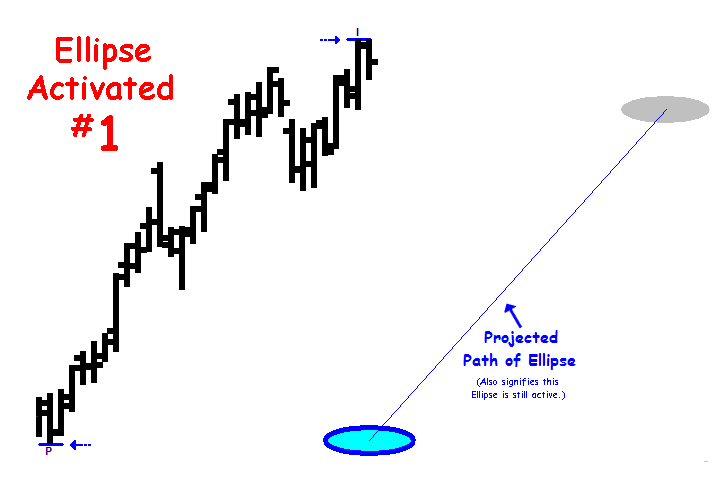

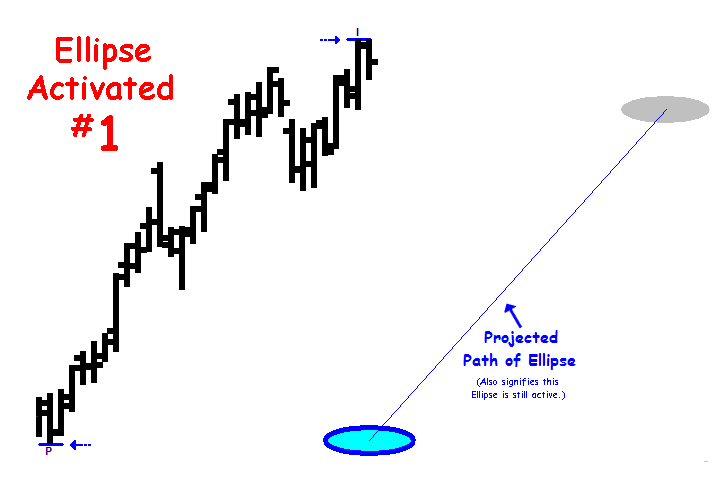

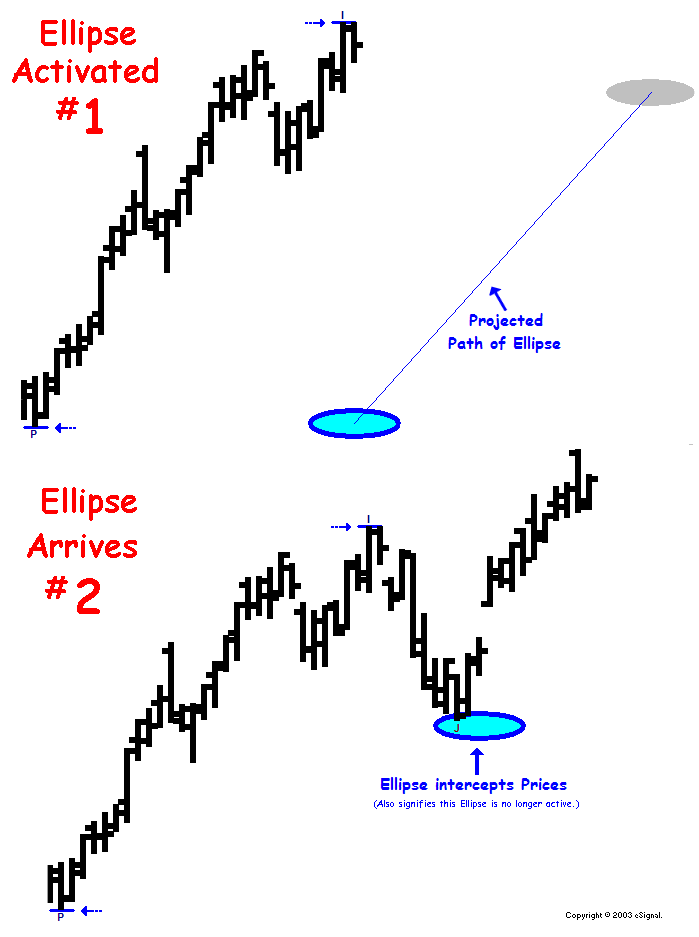

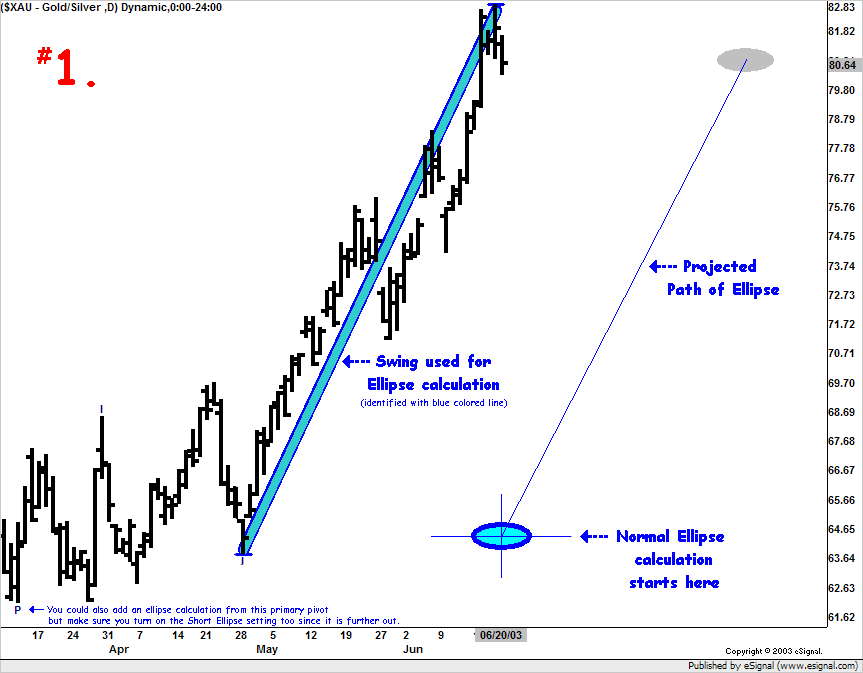

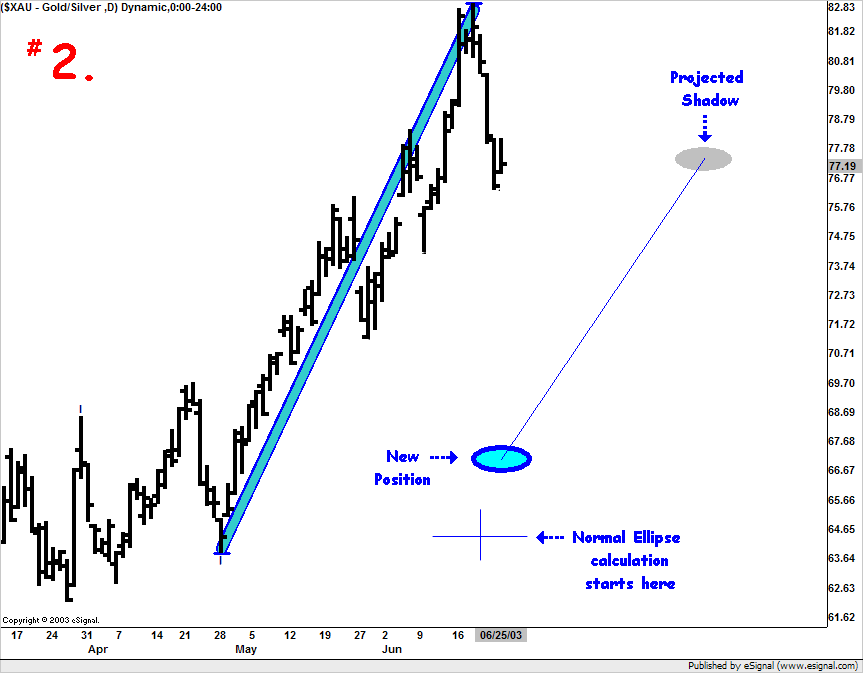

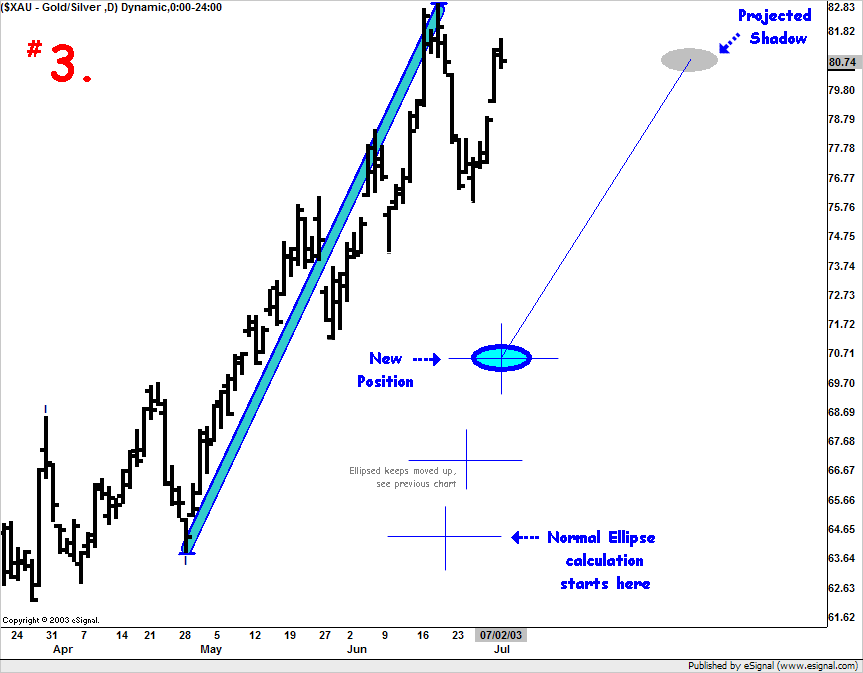

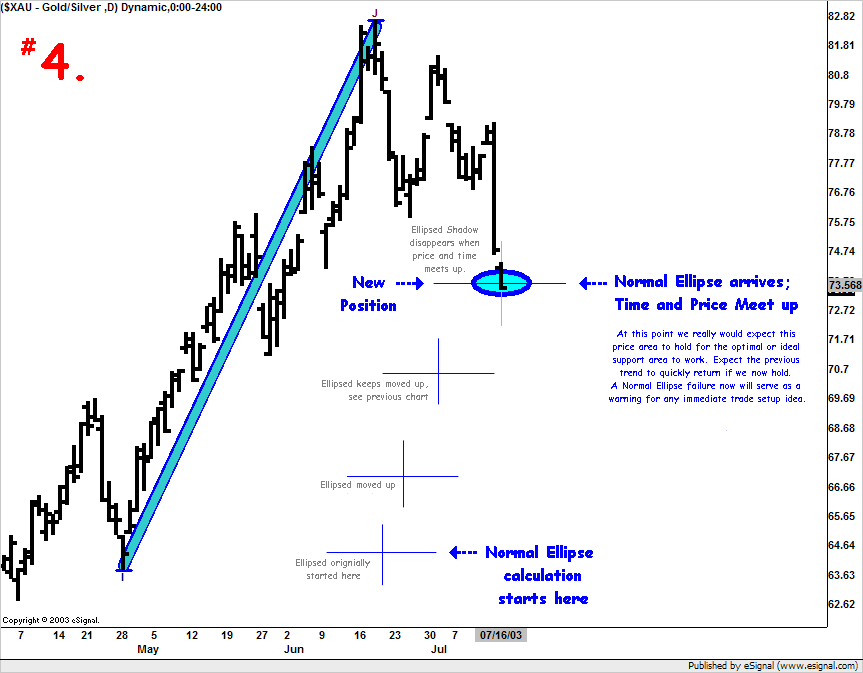

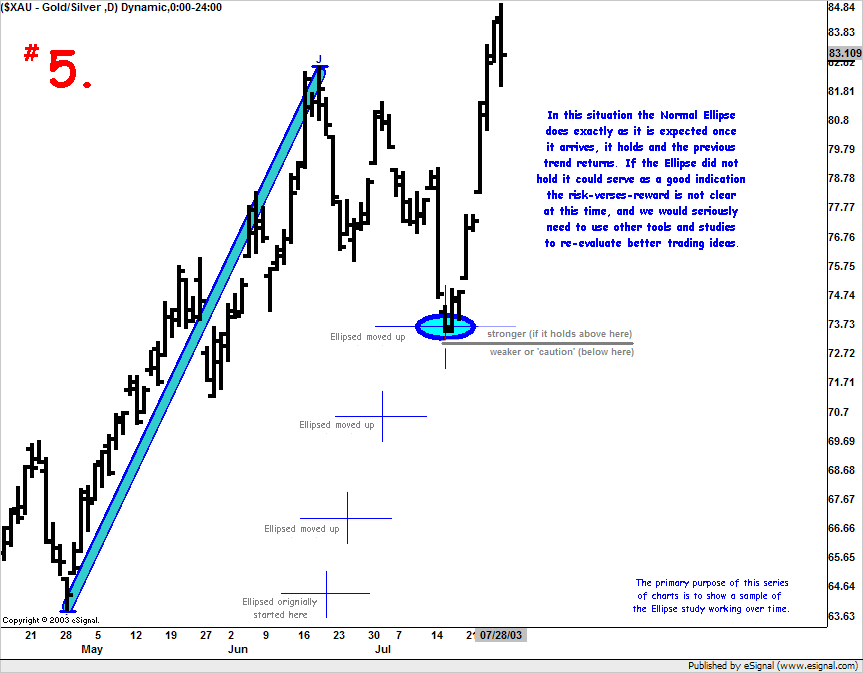

Ellipse Projection (Shadow)-- Once the Ellipse study is applied, it marks a line ending with a shadow to project the path it anticipates the Ellipse to move as we now track for future time to intercept with the future price movement. The steeper the angle, the quicker we can anticipate the Ellipse moving toward the price as less time may be factored into the equation.

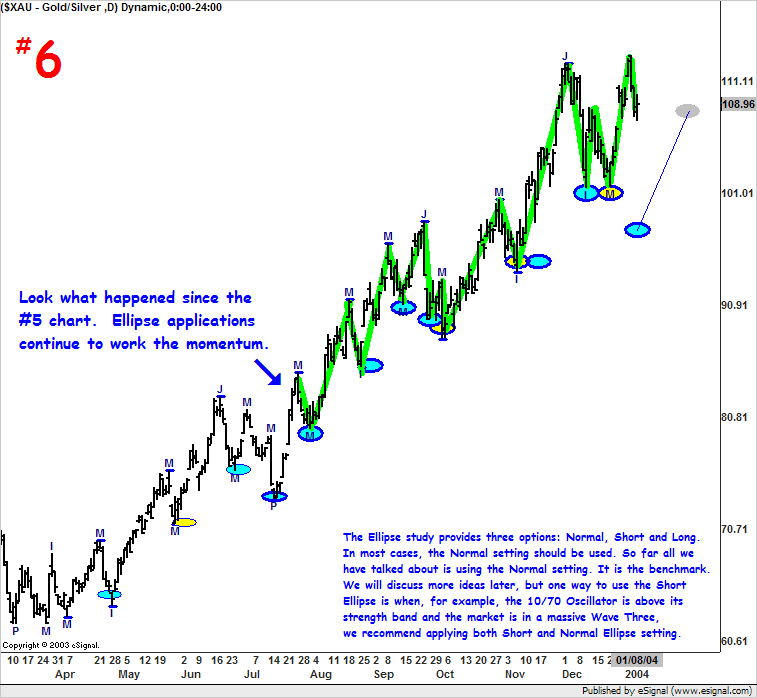

Comment