Alexis, Garth, Marc, whoever...

Lately I'm hooked on the TPS line tool drawn from the most recent major pivot point. I use the TPS in conjunction with the E-waves. Lately the TPS (time lines) have been lining up well with the W5, W4, etc... +- a few bars. This isn't an original thought - I think I saw someone else talking about this in this forum (was it G?)

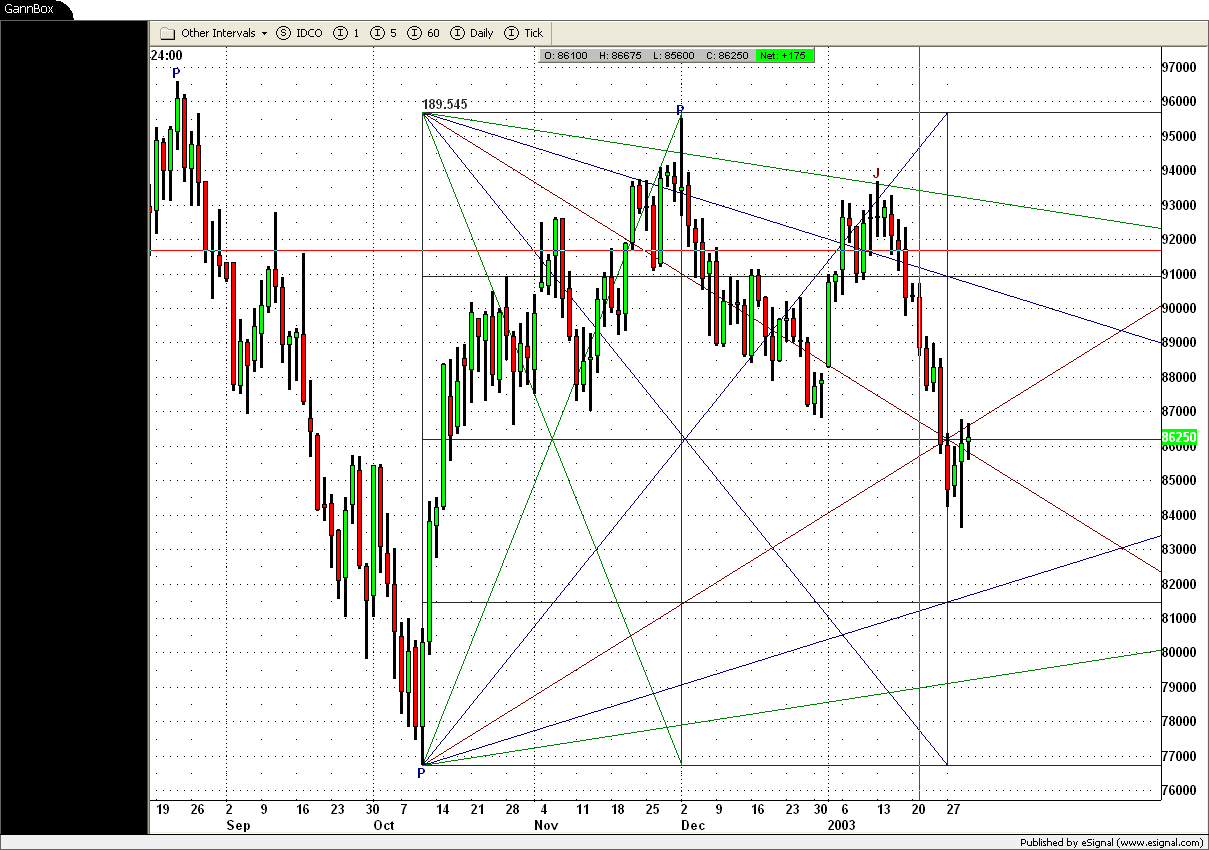

I've seen y'all talk about the Gann and I'm playing with it trying to figure it out. First I tried Auto Gann and didn't see much. Then tried plotting a few Gann's and I'm not sure what I'm looking at or what to look for.

Could someone make some real world examples and talk about them -- an educational primer???

Lately I'm hooked on the TPS line tool drawn from the most recent major pivot point. I use the TPS in conjunction with the E-waves. Lately the TPS (time lines) have been lining up well with the W5, W4, etc... +- a few bars. This isn't an original thought - I think I saw someone else talking about this in this forum (was it G?)

I've seen y'all talk about the Gann and I'm playing with it trying to figure it out. First I tried Auto Gann and didn't see much. Then tried plotting a few Gann's and I'm not sure what I'm looking at or what to look for.

Could someone make some real world examples and talk about them -- an educational primer???

Comment