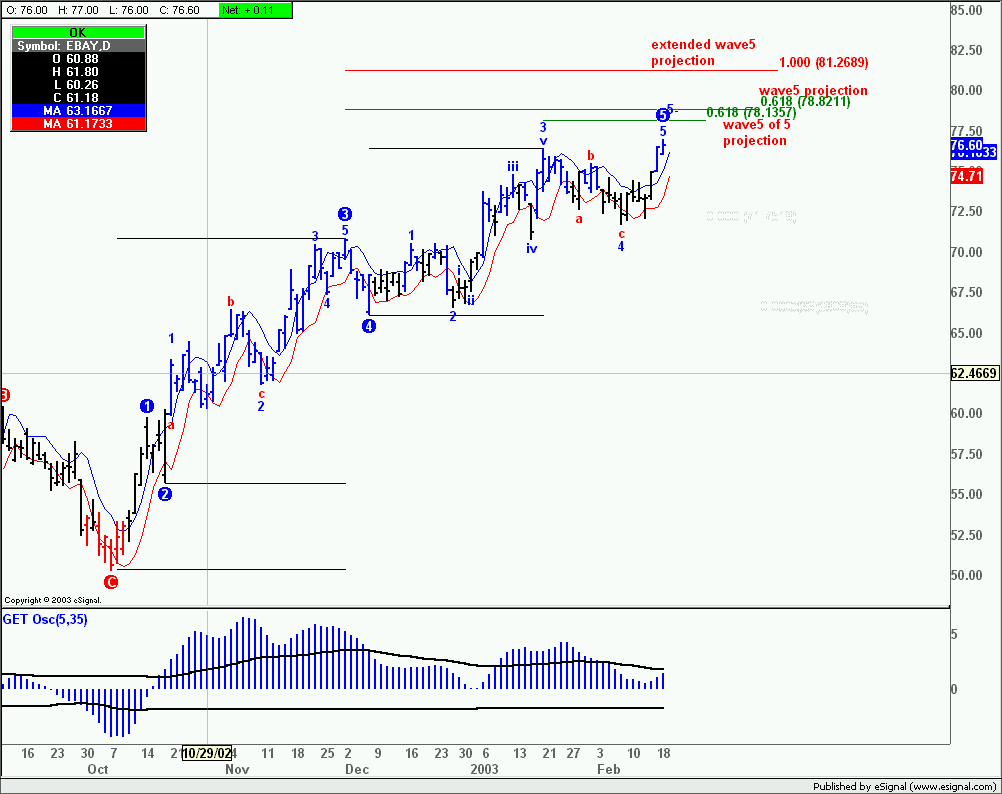

If W5 contains more up bars and is longer in duration

than W3, would this imply that the entire impulse

pattern will be re-labled a wave 3? For instance, if

you look at EBAY on a daily chart, you'll see a nice

impulse wave pattern with diverging 5,35 OSC. Since

W5 is longer that W3, would the entire sequence be

re-labeled as a W3 top (versus W5 top)?

than W3, would this imply that the entire impulse

pattern will be re-labled a wave 3? For instance, if

you look at EBAY on a daily chart, you'll see a nice

impulse wave pattern with diverging 5,35 OSC. Since

W5 is longer that W3, would the entire sequence be

re-labeled as a W3 top (versus W5 top)?

Comment