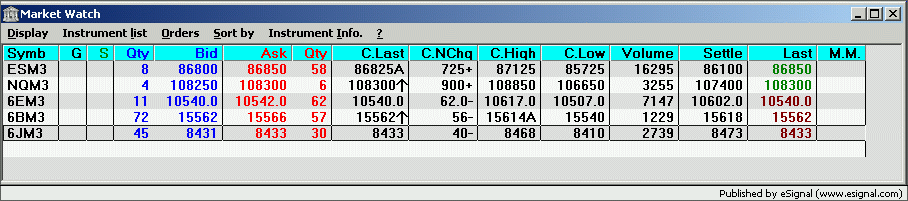

None of my prices for CME futures contracts have any decimal places in them. The scaling is off by a factor of 100x up to 100000x.

For example, my eSignal 7.2 quote window shows:

EC M3 as 106030, it should be 1.0603

JY M3 as 8471, it should be .8471

ND M3 as 107500, it should be 1075.00

NQ M3 as 107550, it should be 1075.50

SP M3 as 85770, it should be 857.70

ES M3 as 85775, it should be 857.75

Is there a way to adjust this?

Brad

For example, my eSignal 7.2 quote window shows:

EC M3 as 106030, it should be 1.0603

JY M3 as 8471, it should be .8471

ND M3 as 107500, it should be 1075.00

NQ M3 as 107550, it should be 1075.50

SP M3 as 85770, it should be 857.70

ES M3 as 85775, it should be 857.75

Is there a way to adjust this?

Brad

Comment