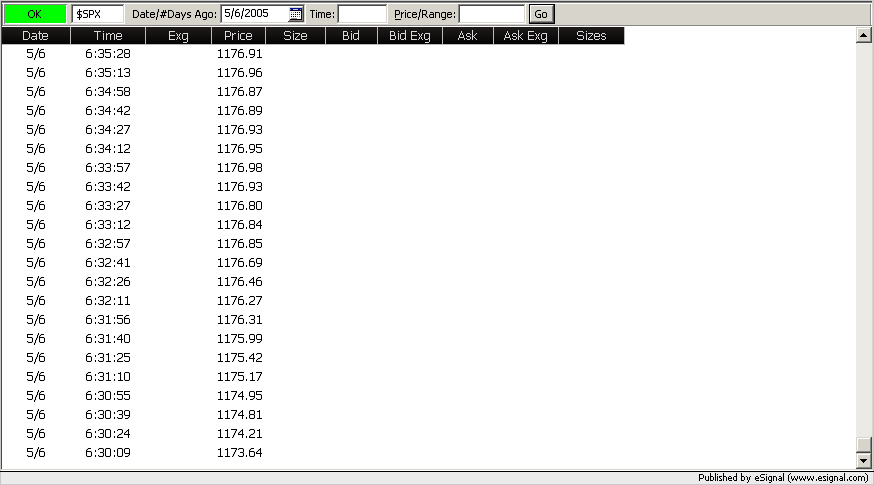

I am a new customer who is in the process of evaluating data quality. I have so far noted that ticks are universally missing for the cash indices and therefore I assume all financial instruments. I use cash index data for my initial evaluation, because the exchange has a controlled timed release. An example is $SPX which transmits at 15 second intervals. A list as provided by eSignal is http://www.esignalcentral.com/suppor...esigind_ac.asp

Does eSignal consider this an issue or for it to be acceptable? If it is something they consider wrong; How long to fix?

Thanks

Does eSignal consider this an issue or for it to be acceptable? If it is something they consider wrong; How long to fix?

Thanks

Comment