Is there a default setting for contract rollovers for US indices and EU indices?

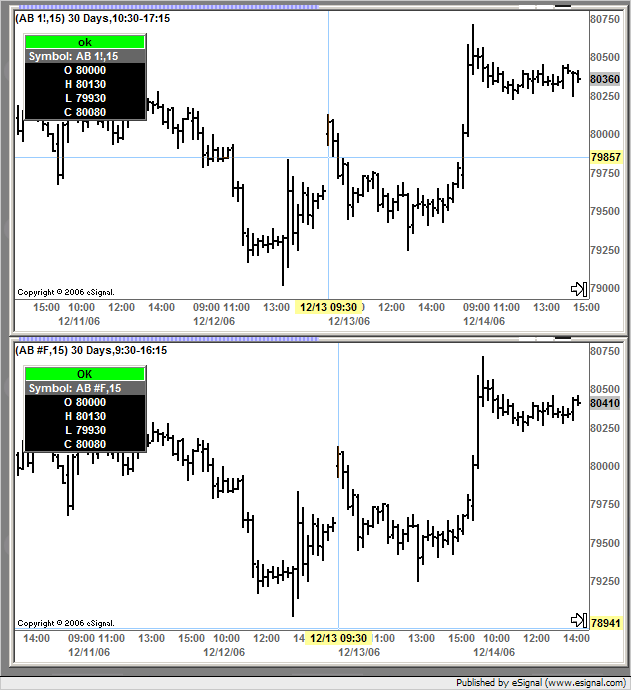

For instance, if I use AB #F every three months I am going to get a 7-8 point gap that screws up all my charts and previous key points.

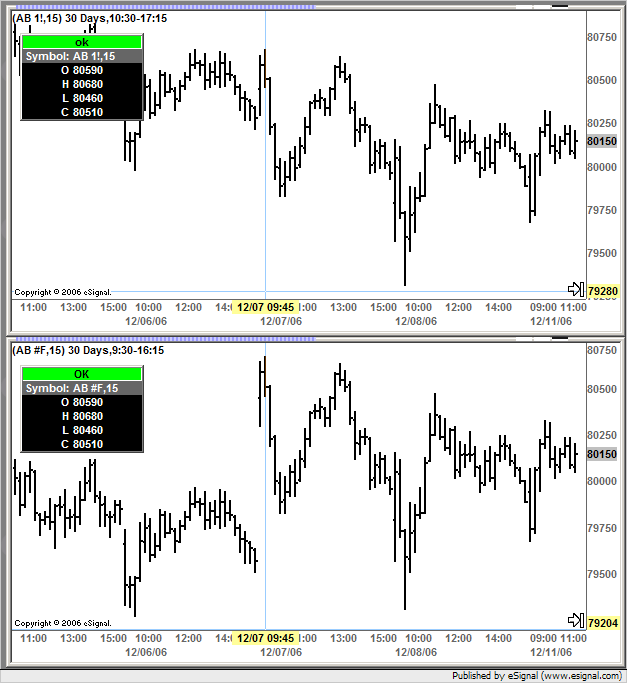

If I enter the AB 1! symbol, I get different data for the open.

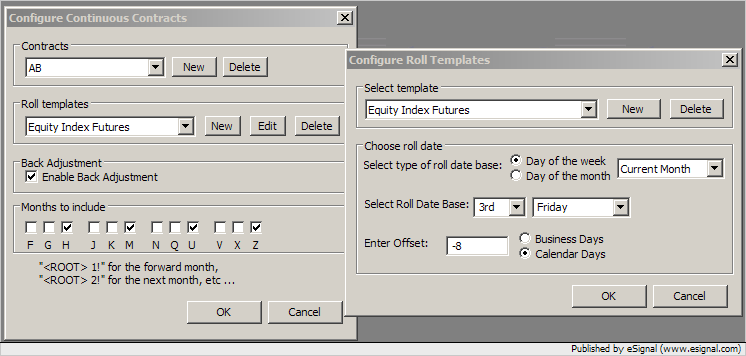

Why doesnt AB #F automatically adjust to the new prices?

I have been using AX 1! for over 2 months now and I didnt even know of all this problems...I am wondering whether I have been looking at the right chart !!!

For instance, if I use AB #F every three months I am going to get a 7-8 point gap that screws up all my charts and previous key points.

If I enter the AB 1! symbol, I get different data for the open.

Why doesnt AB #F automatically adjust to the new prices?

I have been using AX 1! for over 2 months now and I didnt even know of all this problems...I am wondering whether I have been looking at the right chart !!!

Comment