Hello,

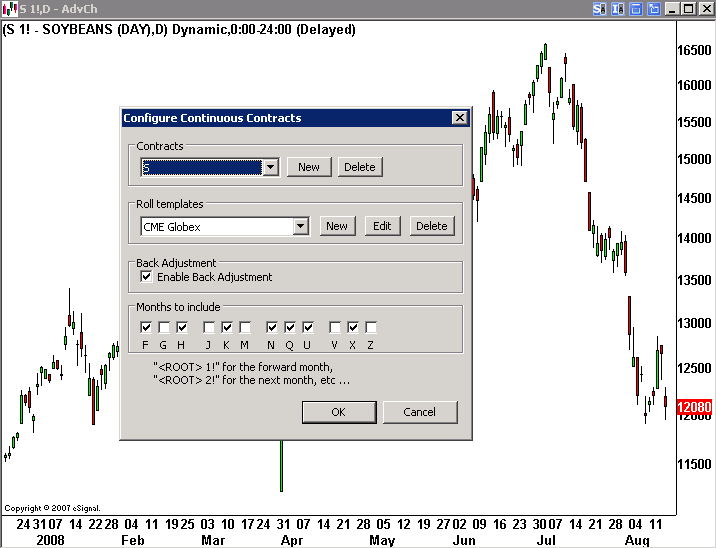

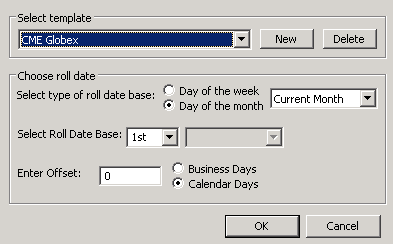

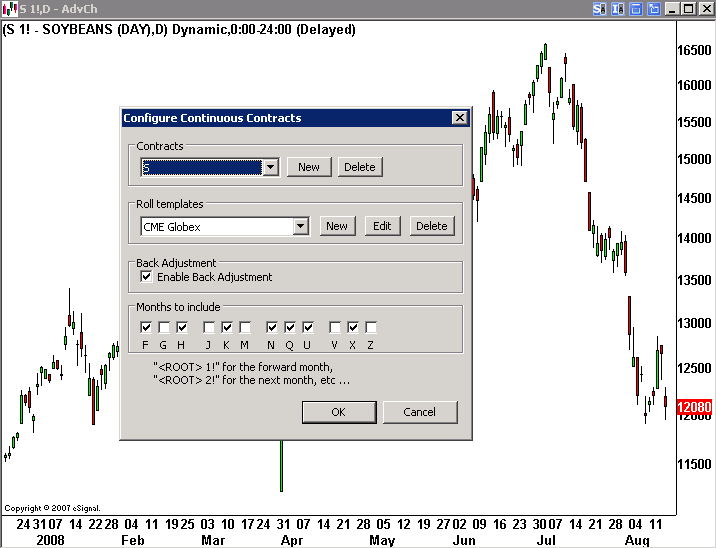

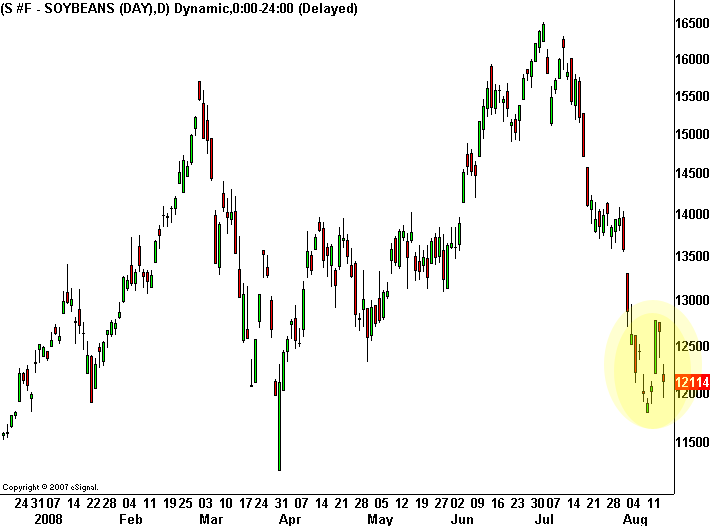

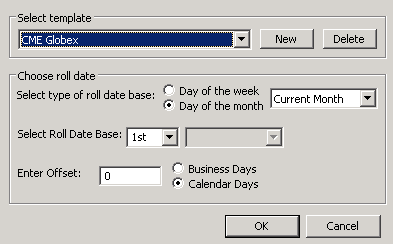

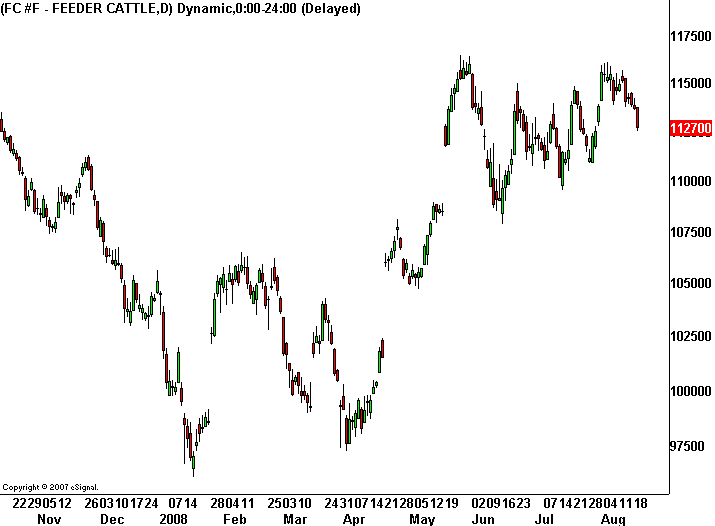

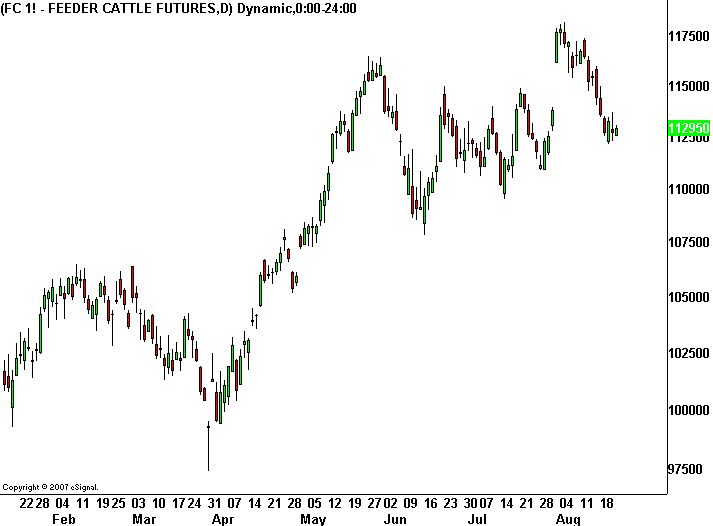

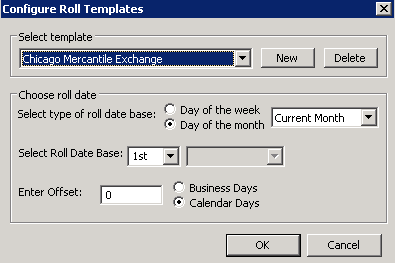

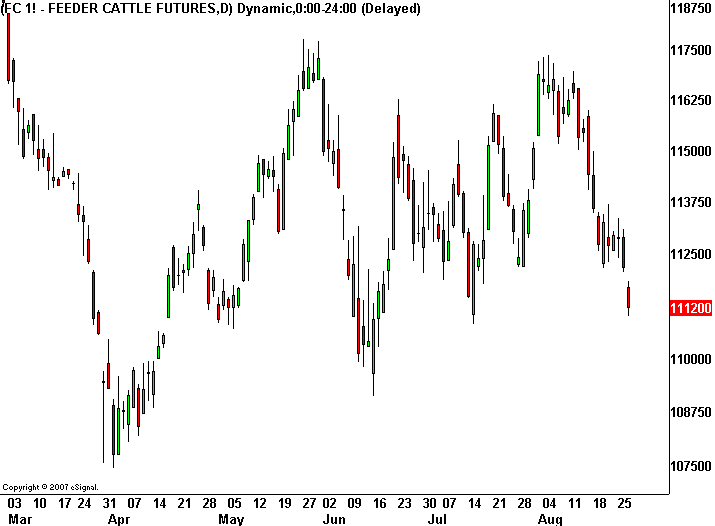

i need a chart without the Rollover Gaps. Can you tell me, if my chart is correkt?

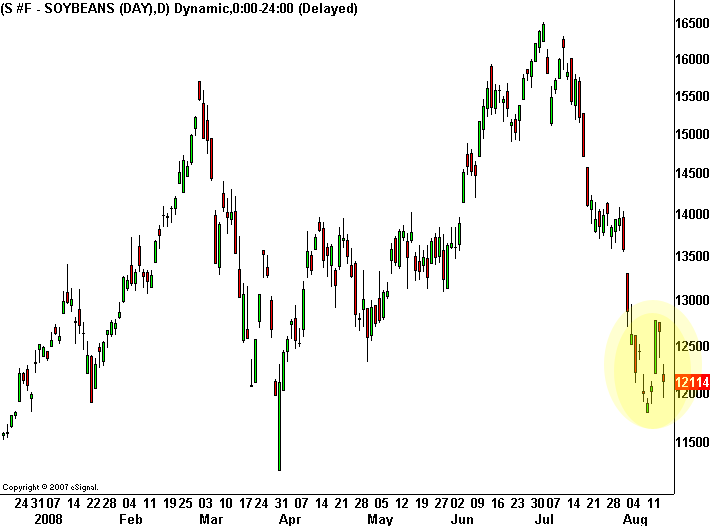

I think there are too small differents between the S #F, so i think anythin is wrong.

Best regards

Catano

i need a chart without the Rollover Gaps. Can you tell me, if my chart is correkt?

I think there are too small differents between the S #F, so i think anythin is wrong.

Best regards

Catano

Comment