Backtesting futures data.

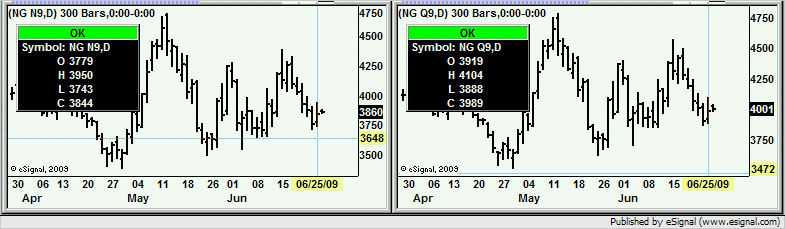

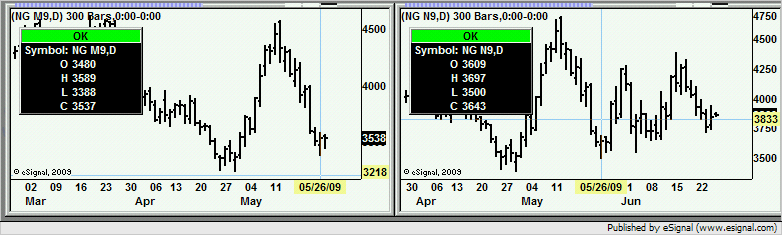

Need to use the Continuous Contract option 1! to smooth out rollovers.

Can anyone tell me how this is calculated.

I can get a contant back adjusting value but cannot figure out how this number is derived...

Please help ?? Under time pressure from above.

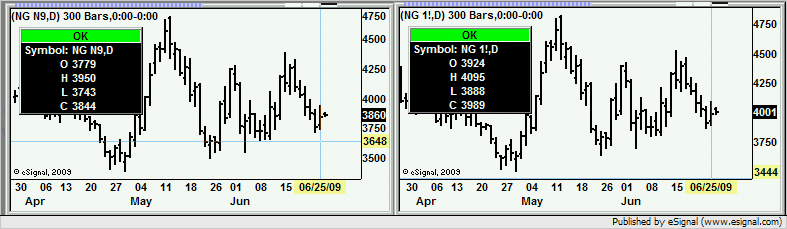

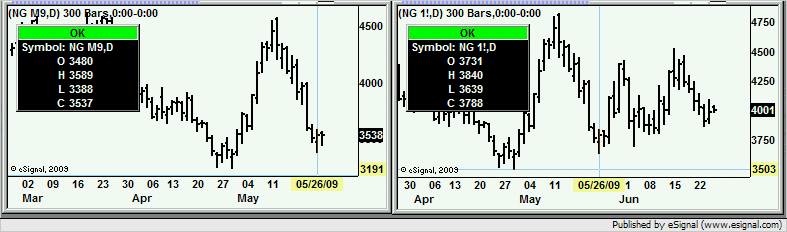

Need to use the Continuous Contract option 1! to smooth out rollovers.

Can anyone tell me how this is calculated.

I can get a contant back adjusting value but cannot figure out how this number is derived...

Please help ?? Under time pressure from above.

Comment