Hello

Even after reading the relevant articles (1412, 2258) in the KB and also some posts in the forum, I am still not sure what can be done regarding continuous futures contracts.

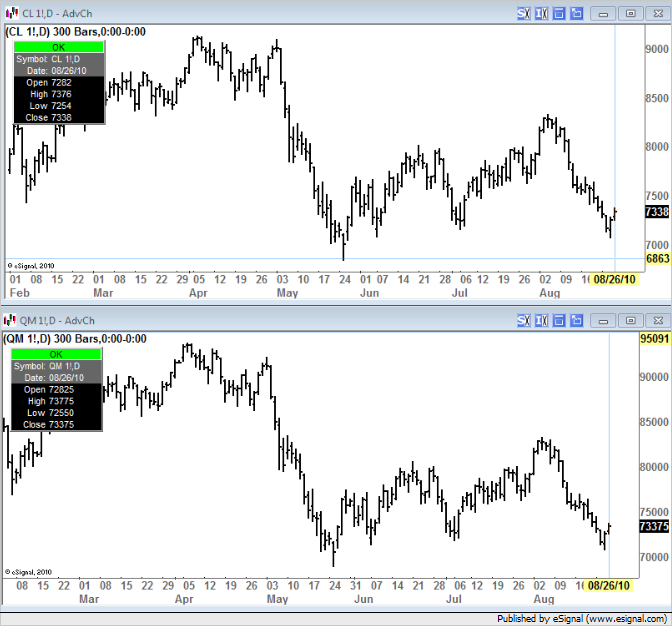

I would like to get price-adjusted continuous futures data for backtesting purposes. As far as I understand the #F-contracts (e.g. QM #F) are not back-adjusted. Nevertheless, you can check the "Enable Back Adjustment" box in the "Configure Continuous Contracts-menu" for the root ticker (e.g. QM). But that does not seem to change the data for QM #F when I export it into Excel and compare with the non-adjusted data.

Are the #F-contracts already back-adjusted ? If not how can I do that or generate myself new contracts with the relevant tickers which are back-adjusted (e.g. QM).

Thank you for the help

Kind Regards

Even after reading the relevant articles (1412, 2258) in the KB and also some posts in the forum, I am still not sure what can be done regarding continuous futures contracts.

I would like to get price-adjusted continuous futures data for backtesting purposes. As far as I understand the #F-contracts (e.g. QM #F) are not back-adjusted. Nevertheless, you can check the "Enable Back Adjustment" box in the "Configure Continuous Contracts-menu" for the root ticker (e.g. QM). But that does not seem to change the data for QM #F when I export it into Excel and compare with the non-adjusted data.

Are the #F-contracts already back-adjusted ? If not how can I do that or generate myself new contracts with the relevant tickers which are back-adjusted (e.g. QM).

Thank you for the help

Kind Regards

Comment