I get a feeling that DTB / Eurex is not supplying good quality data to brokers / data vendors.

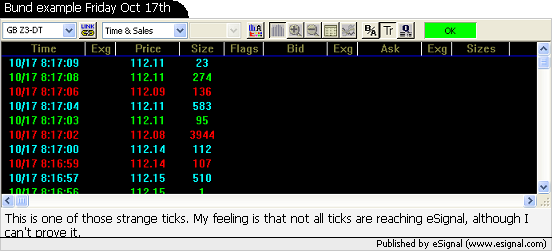

There's some very strange movements this morning (and for the last couple of days actually) with trades suddenly moving up or down 3-5 ticks. This happens in periods when there is no shocking news.

These 'strange' ticks can be seen in eSignal, Interactive Brokers and whSelfinvest, so it doesn't seem to be an issue with eSignal etc.

Can anybody comment on this? Perhaps offer an explanation for what I see happening?

Thanks in advance,

Edo.

There's some very strange movements this morning (and for the last couple of days actually) with trades suddenly moving up or down 3-5 ticks. This happens in periods when there is no shocking news.

These 'strange' ticks can be seen in eSignal, Interactive Brokers and whSelfinvest, so it doesn't seem to be an issue with eSignal etc.

Can anybody comment on this? Perhaps offer an explanation for what I see happening?

Thanks in advance,

Edo.

Comment