Hello

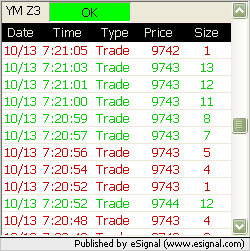

I used to work with 400V interval for YM#f and today there's something wrong, I have only about 7 Bars by hours.

Could you check this ?

Thank you.

I used to work with 400V interval for YM#f and today there's something wrong, I have only about 7 Bars by hours.

Could you check this ?

Thank you.

Comment