Can eSignal send data to excel from my spread charts including study values? I know how to use dde links, but I can't figure out how to refer to spreads or studies. I found the few qualifiers listed, but that can't be all there is, right?

Announcement

Collapse

No announcement yet.

dde spread symbols

Collapse

X

-

Hi,

You should be able to build your own spread in Excel by just taking each symbol into seperate cells, then running a calculation against those cells. You can output a study value from an Advanced Chart to a DDE link. This KB article describes the DDE output function.

Thanks.

-

Thank you very much for the link. Can the "getSymbol" function get spread symbols? I would like to get a moving average of a spread into excel. I've experimented with calculating the spread's moving average by using the moving averages of the individual legs, but I don't get a precise enough match to the moving average eSignal gives me on the spread chart.

Comment

-

jobe1

Yes it can. If you want you can also calculate the moving average directly on the spread using the sym() function.

Enclosed below is a very basic example of how to write a simple moving average of a spread which you could then feed to Excel via DDE (instructions on how to pass studies via DDE are available at the link provided to you by Scott Johnson).

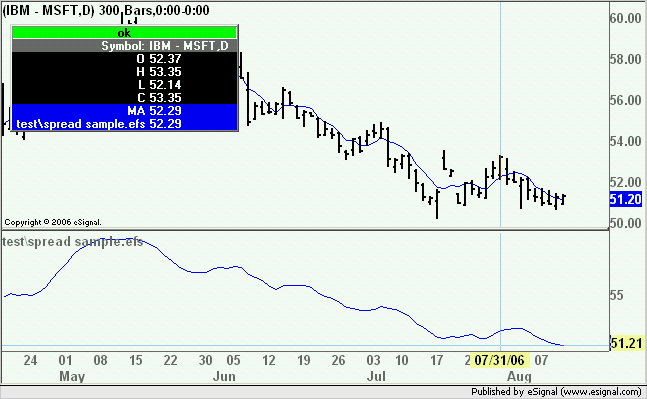

In the image that follows the sample script is running as a non price study while the price pane includes the Basic Studies Moving average. As you can see the values are identical.

Alex

PHP Code:var myAvg = null;

function main(){

if(myAvg==null) myAvg = sma(5,sym("IBM - MSFT"));

if(myAvg.getValue(0)==null) return;

return myAvg.getValue(0);

}

Comment

-

OK, I've been picking away at this a little bit. Using the page referenced by Scott, I opened the EFS editor and copy/pasted the code for the ddeOutput MA study. I named the study ddeOutput. Then I discovered I wanted a different length movavg, so I opened the study in the editor, changed the length from 10 to 60, and saved as "ddeMA60." I repeated the process for my favorite MA lengths. However, when I try to link to excel, it returns the original length of 10. So, I looked at the first part again:

I thought if I changed the second line in my ddeMA60 from "movavg" to "movavg60" that I would be able to reference my ddeMA60 study in excel with the syntax "=eSignal|EFS!movavg60SPREAD." However, excel returns "NAME!."PHP Code:var study = new MAStudy(10, 0, "Close", MAStudy.SIMPLE);

var dde = new DDEOutput("movavg" + getSymbol());

Alexis, I haven't tried your solution yet because I am woefully ignorant about the fundamentals of EFS and don't understand completely what I've done so far.

I hesitate to ask for further help from you guys seeing as I haven't invested many hours in learning EFS, but if you were to pass on one tip, I could use suggestions regarding how to name and file the studies I create.

Comment

-

Where is THIS documented?

Now where is THIS documented?

sma(5,sym("IBM - MSFT"));

This is just too dang funny.

You can't have:

sma(5, sym("IBM"), inv(5))

If you code "If" instead of "if" it's an error

but you can have:

sma(5,sym("IBM - MSFT"));

Now I know whoever is behind this EFS code has very sick & twisted mind!

I decided to test beyond reason....

Even this works:

PHP Code:var myAvg = null;

function main(){

myAvg = close(5,sym("QQQQ - MSFT + NTRI / GOOG"));

if(myAvg==null) return;

return myAvg;

}

Last edited by buzzhorton; 08-12-2006, 06:31 PM.

Comment

-

Thanks, BuzzHorton, for sharing my pain.

I did go back and try some more. I figured out that if I name my study according to the periodicity of the chart in addition to the length of the movavg I want on that chart, my first assumption at changing the second line of the first part of the linked code works just fine. I just know I'm going about this in the most back assward way possible, but I'm satisfied with the results.

Comment

-

I might as well just say it. The way I call the study in excel is as follows:

For a 1 min chart, my 50 period moving average study is called with "movavg1.50<spread sym>" instead of just "movavg."

For a 60 min chart, my 30 period moving average study is called with "movavg60.30<spread sym>."

etc.

I haven't tackled Alexis's solution yet. I'm sure it's the way to a more elegant solution. If anyone thinks it would pay off in the long run to go at this a different way, I would appreciate the suggestion. Thank you everyone for helping me solve my problem.

Comment

-

Buzz-

I trade futures at the CBOT, mainly in spreads. I'm also an electronic broker for locals in the pit who don't want to maintain their own electronic order entry infrastructure. It's a combination of these two activities, plus my relationship with my clearing firm that I choose to use Trading Technologies' front end software, X_Trader Pro. Using X_Trader, I am plugged in directly from my firm's server to the exchange's server, without having to go through an ISP as I would if I were to use the order entry mechanisms provided by my data vendors, CQG and eSignal.

Trading Technologies has a plug-in the enables me to feed it theoretical values generated in Excel. It also has a charting program that could provide the study values I'm working at getting from eSignal, but my IT guy doesn't want to set it up until he puts out a few unrelated fires. I will keep eSignal no matter what, because they've chosen to provide features unavailable through other vendors. Their charting options are top notch (though I'm not a fan of how their point and figure charts work).

Basically, I am using eSignal and Excel as the engine for a half-assed trading system that will day-trade spreads automatically utilizing eSignal's data and charting, Excel's dde functionality, and Trading Technologies' AutoSpreader and SpreadDriver applications.

Have I bitten off more than I can chew? Probably. This may be the Rube Goldberg of Rube Goldbergs.

Comment

Comment