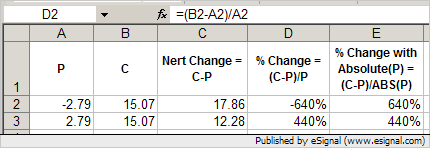

For spreads that have negative values, the Change and Pct columns show the correct color, but the Pct column shows a plus sign when it should be a minus sign and vice versa. There's a - in front of a green number and a + before a red number in the Pct column for the negative spreads as the screenshot shows .

8.0 build 782 on Windows 2000 Pro here.

8.0 build 782 on Windows 2000 Pro here.

Comment