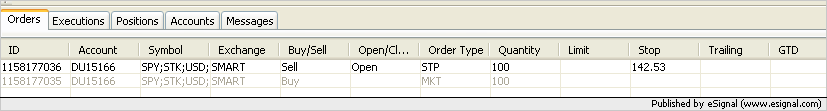

I got the error message "Stop price must be greater than 0".

What is wrong with my code? The current price is about 142.50 in edemo.

function preMain() {

setPriceStudy(false);

setStudyTitle("ATS_IBBridge_Testing");

setShowCursorLabel(false);

//setComputeOnClose();

}

function main( ) {

if ( getBarState() == BARSTATE_ALLBARS ) {

setStudyMax(100);

setStudyMin(0);

displayBuySellButtons();

}

}

function clickBuyMkt() {

buyMarket("SPY", 100);

sellStop("SPY", 100, formatPriceNumber(140.00)*1);

//sellStop("SPY", 100, formatPriceNumber(140.00));

}

function clickSellMkt() {

sellMarket("SPY", 100);

buyStop("SPY", 100, formatPriceNumber(145.00)*1);

}

What is wrong with my code? The current price is about 142.50 in edemo.

function preMain() {

setPriceStudy(false);

setStudyTitle("ATS_IBBridge_Testing");

setShowCursorLabel(false);

//setComputeOnClose();

}

function main( ) {

if ( getBarState() == BARSTATE_ALLBARS ) {

setStudyMax(100);

setStudyMin(0);

displayBuySellButtons();

}

}

function clickBuyMkt() {

buyMarket("SPY", 100);

sellStop("SPY", 100, formatPriceNumber(140.00)*1);

//sellStop("SPY", 100, formatPriceNumber(140.00));

}

function clickSellMkt() {

sellMarket("SPY", 100);

buyStop("SPY", 100, formatPriceNumber(145.00)*1);

}

Comment