I´m lookimg for the formula for a backtest with

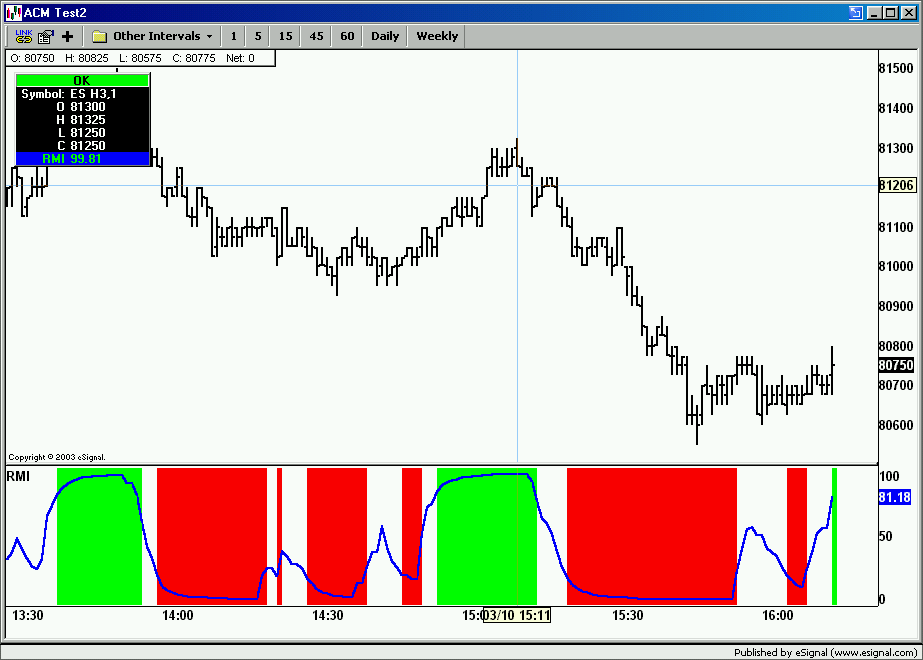

the RMI. (3,8)

1. if RMI > 80 go LONG

2. if RMI < 20 go SHORT

Can someone help me, how I provide this formula??

Thanks

the RMI. (3,8)

1. if RMI > 80 go LONG

2. if RMI < 20 go SHORT

Can someone help me, how I provide this formula??

Thanks

Comment