Here is the OddBall strategy - as originally created by Mark Brown - ported to efs.

"OddBall-Signals.efs", here attached, can operate as a standalone but if one wants to see also the other two indicators that are visible in the images below you will need to run "OddBall-RoC.efs" and "OddBall-$ADV.efs" which are posted in subsequent messages.

To run this efs correctly you need to create a 60 min chart of ES, SP or SPY with a Time Template set to 09:00-16:00 EST (or equivalent if you are on a different time zone).

The symbol normally used for OddBall is the $SPX, but because in eSignal we can limit SP, ES and SPY trading hours, through the use of the Time Template, you can use these symbols.

The last signal of a day on the original system is at 16:00 EST anyhow so it does not matter if the last 15 minutes of ES, SP or SPY are not plotted.

OddBall is a SAR system and is always in the market either Long or Short. It computes the trading signal at the close of every 60 minute period using natural hours set by the Time Template's start time. The signals are generated by a 7 period Rate of Change of the NYSE Advancing Issues. If the RoC is above 3 the system goes long if below 3 it goes short.

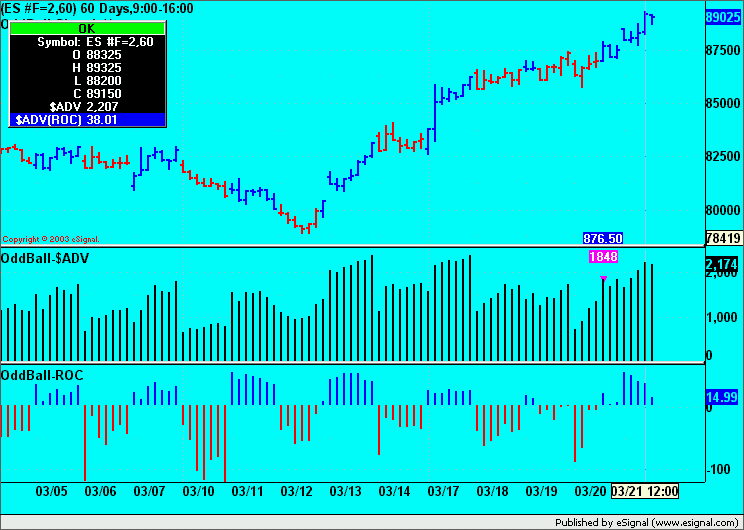

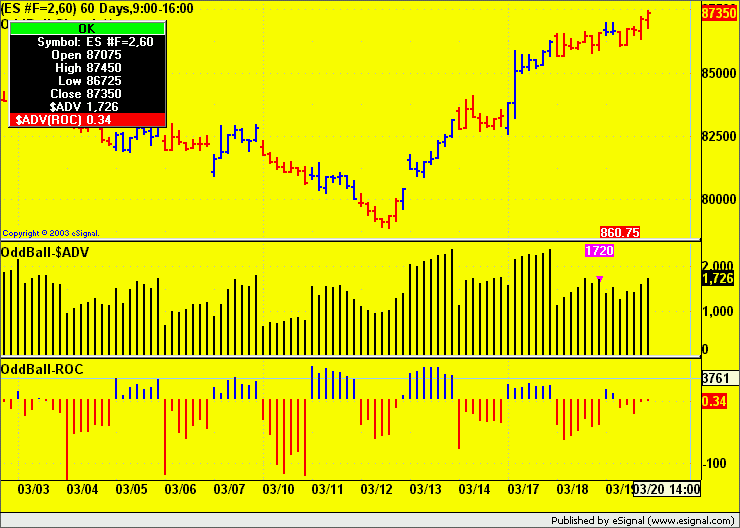

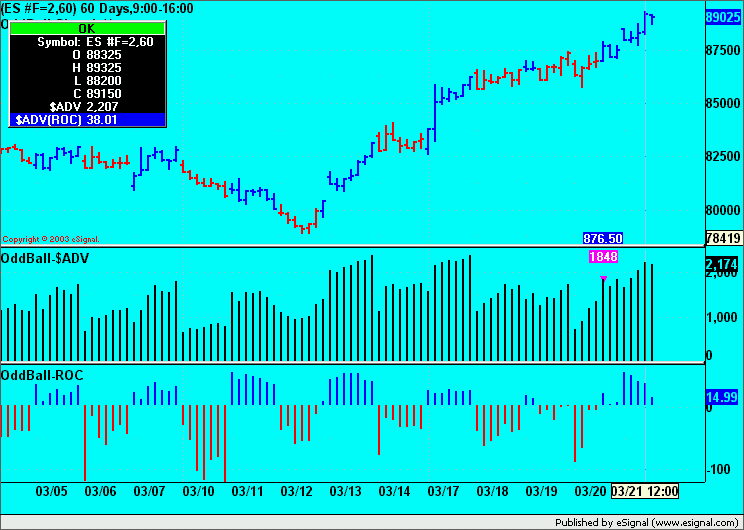

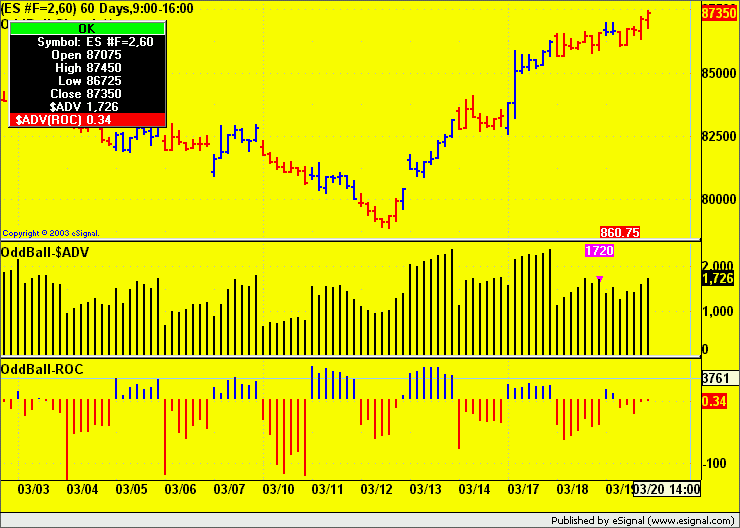

The basic efs does the following:

- computes the RoC of $ADV (but does not plot it)

- paints the bars in which the system is Long in blue and those in which it is short in red.

- if Long paints the chart background in cyan, if short paints it in yellow.

- writes the price of the last entry (in white text over blue background if Long or in white over red background if Short) at the bottom of the chart centered to the bar that generated the signal.

- issues a Buy/Sell order at the Close of the bar that generates the signal. NOTE: Although this may appear artificial, because if a signal is generated on the close of last bar of the day it would not be possible to execute it, one needs to consider that there are actually 15 more minutes of trading time past the last signal of a day.

Here below is an image of the system when Long

And here one of the system when Short.

Some additional notes and comments are available in the efs itself. These include how to enable the email, sound and visual alerts.

No comments are here made or implied with regards to the merits (if any) of the system. From my point of view this was simply an exercise in writing some code.

Alex

"OddBall-Signals.efs", here attached, can operate as a standalone but if one wants to see also the other two indicators that are visible in the images below you will need to run "OddBall-RoC.efs" and "OddBall-$ADV.efs" which are posted in subsequent messages.

To run this efs correctly you need to create a 60 min chart of ES, SP or SPY with a Time Template set to 09:00-16:00 EST (or equivalent if you are on a different time zone).

The symbol normally used for OddBall is the $SPX, but because in eSignal we can limit SP, ES and SPY trading hours, through the use of the Time Template, you can use these symbols.

The last signal of a day on the original system is at 16:00 EST anyhow so it does not matter if the last 15 minutes of ES, SP or SPY are not plotted.

OddBall is a SAR system and is always in the market either Long or Short. It computes the trading signal at the close of every 60 minute period using natural hours set by the Time Template's start time. The signals are generated by a 7 period Rate of Change of the NYSE Advancing Issues. If the RoC is above 3 the system goes long if below 3 it goes short.

The basic efs does the following:

- computes the RoC of $ADV (but does not plot it)

- paints the bars in which the system is Long in blue and those in which it is short in red.

- if Long paints the chart background in cyan, if short paints it in yellow.

- writes the price of the last entry (in white text over blue background if Long or in white over red background if Short) at the bottom of the chart centered to the bar that generated the signal.

- issues a Buy/Sell order at the Close of the bar that generates the signal. NOTE: Although this may appear artificial, because if a signal is generated on the close of last bar of the day it would not be possible to execute it, one needs to consider that there are actually 15 more minutes of trading time past the last signal of a day.

Here below is an image of the system when Long

And here one of the system when Short.

Some additional notes and comments are available in the efs itself. These include how to enable the email, sound and visual alerts.

No comments are here made or implied with regards to the merits (if any) of the system. From my point of view this was simply an exercise in writing some code.

Alex

Comment