Bullish / Bearish Sentiment

Thanks Marcus,

Originally posted by MarcRinehart

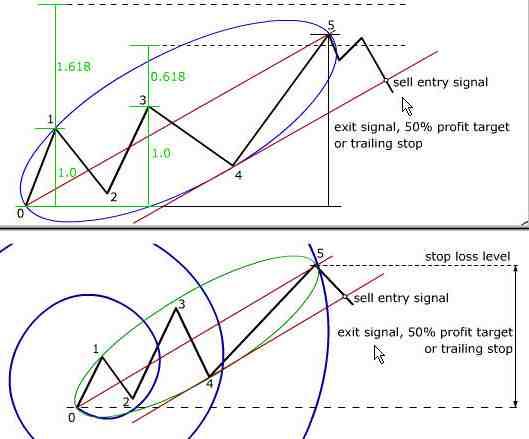

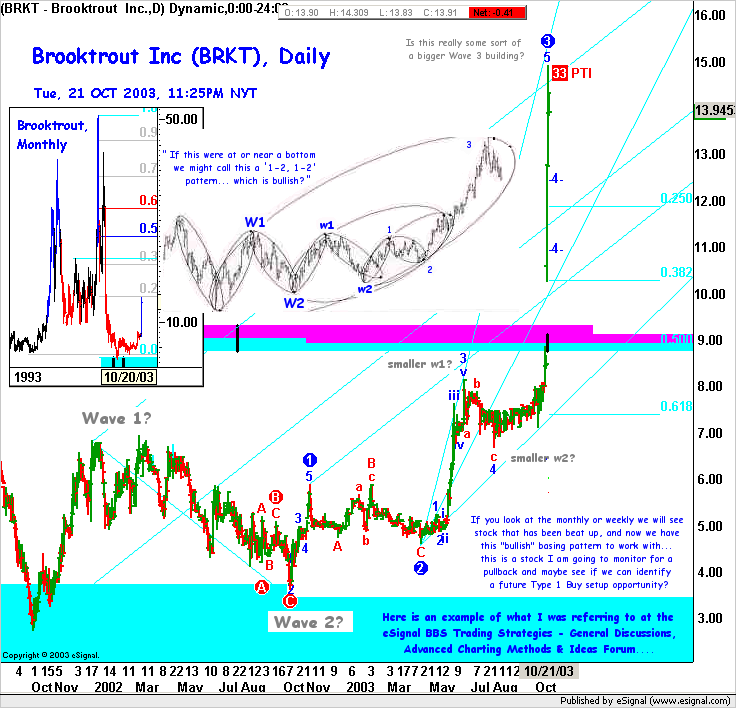

We may call this "1-2,1-2" pattern, which is bullish.

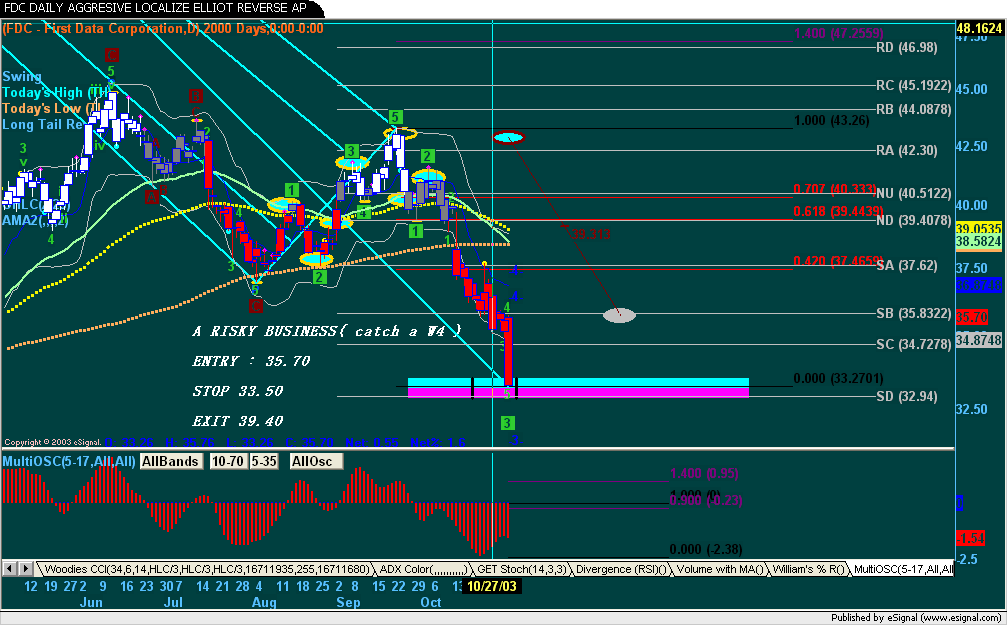

It sure looks bullish short term, but.........denial of any downside

risk spells for an unexpected move coming soon, IMO?

I consider this divergence bearish...let the market be forward

looking.....but, keep your feet on the ground! Watching for

a reversal on the VIX soon?

30minutes into the open....keep eye on RSI and Stochastics

bullish hammer forming?.....very early in day

~j

Thanks Marcus,

Originally posted by MarcRinehart

We may call this "1-2,1-2" pattern, which is bullish.

It sure looks bullish short term, but.........denial of any downside

risk spells for an unexpected move coming soon, IMO?

I consider this divergence bearish...let the market be forward

looking.....but, keep your feet on the ground! Watching for

a reversal on the VIX soon?

30minutes into the open....keep eye on RSI and Stochastics

bullish hammer forming?.....very early in day

~j

Comment