This thread is for new users of eSignal to get familiar with the advanced charting possibilities and techniques for study of the markets and individual stocks. Interactive discussions of charting methods and creative uses for the myriad of charting tools available using this platform. Feel free to post your charts for discussion basic to extreme.

Lets start with a weekly chart of the $INDU, This chart shows a comparison move of 1998. Study the rainbow effect created using multiple moving averages.

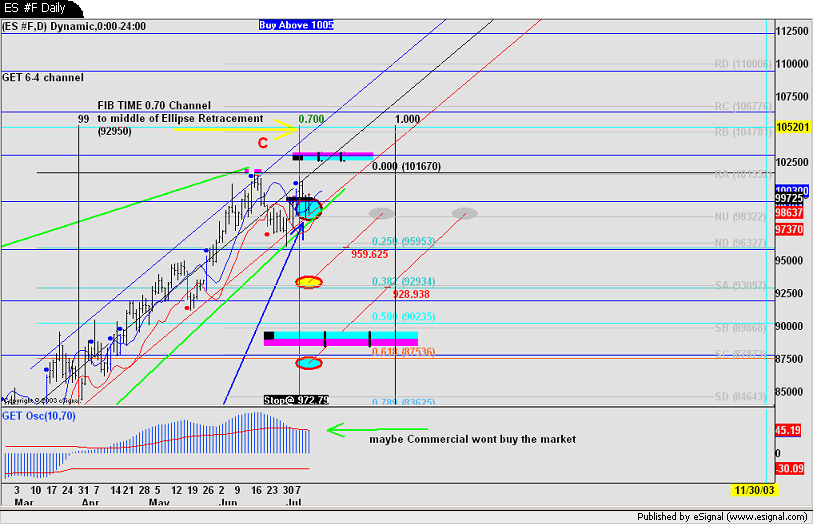

Current Dow chart using daily....notice use of Fibonacci retracements

Happy Charting<g>

~j

Lets start with a weekly chart of the $INDU, This chart shows a comparison move of 1998. Study the rainbow effect created using multiple moving averages.

Current Dow chart using daily....notice use of Fibonacci retracements

Happy Charting<g>

~j

Comment