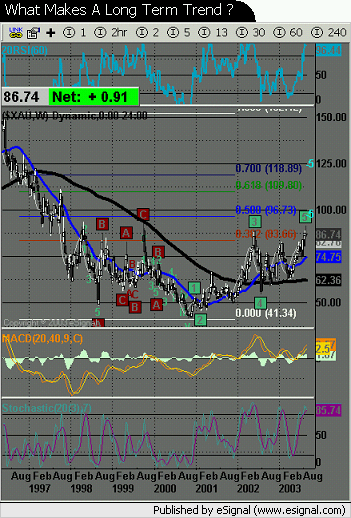

More uses of the circle tool

Hi Linus , That's great your expanding your thoughts and chart.<g>

Here's another idea for you. I'm starting out simple before

springing something large on you. I think you can visualize

the basic concept. Maybe, daily chart not best for demo

but it's what's in front of me...same concept...now play<g>

Thanks for the charts and comments,

~j

Hi Linus , That's great your expanding your thoughts and chart.<g>

Here's another idea for you. I'm starting out simple before

springing something large on you. I think you can visualize

the basic concept. Maybe, daily chart not best for demo

but it's what's in front of me...same concept...now play<g>

Thanks for the charts and comments,

~j

follow-up 13min SP100 chart

follow-up 13min SP100 chart

Comment