Hi All

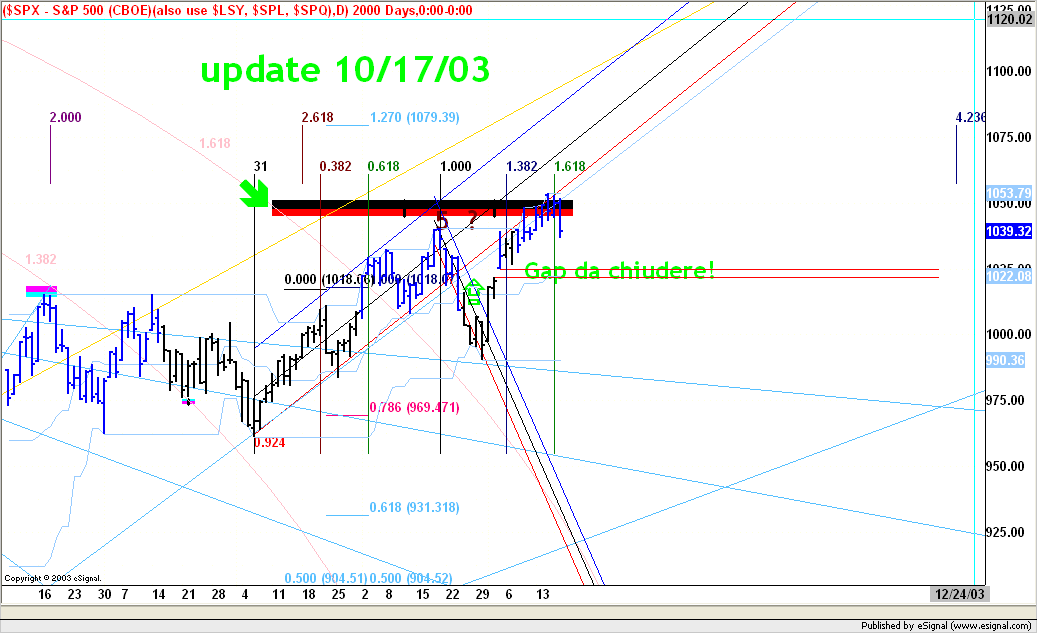

This was a snapshot taken a couple of days ago and goes to show how poor the markets have been recently. Anyone making good money these days has my up-most respect

Sorry about the directional movement frame being in there. Must have slipped in while I wasn't watching

The ATR is looking really poor compare to where in was in March. I thought once the war was over, stock markets picked up

Someone told me than the last time ATR was this low for this long, it started a major move in the markets - let's hope so

This was a snapshot taken a couple of days ago and goes to show how poor the markets have been recently. Anyone making good money these days has my up-most respect

Sorry about the directional movement frame being in there. Must have slipped in while I wasn't watching

The ATR is looking really poor compare to where in was in March. I thought once the war was over, stock markets picked up

Someone told me than the last time ATR was this low for this long, it started a major move in the markets - let's hope so

Comment