David

Attached is the framework efs with the MAs of indicators each one with its own function parameters.

One note regarding the MAofStoch. Since there is a bug which does not allow to directly calculate the MA of StochStudy.SLOW I have implemented a workaround that essentially computes the MA of the MA of StochStudy.FAST.

At this point could you please transfer all the logic of the latest FGallFalse.efs to this one? I would still leave in both strategies ie the original OB/OS and the modified "contrarian" one.

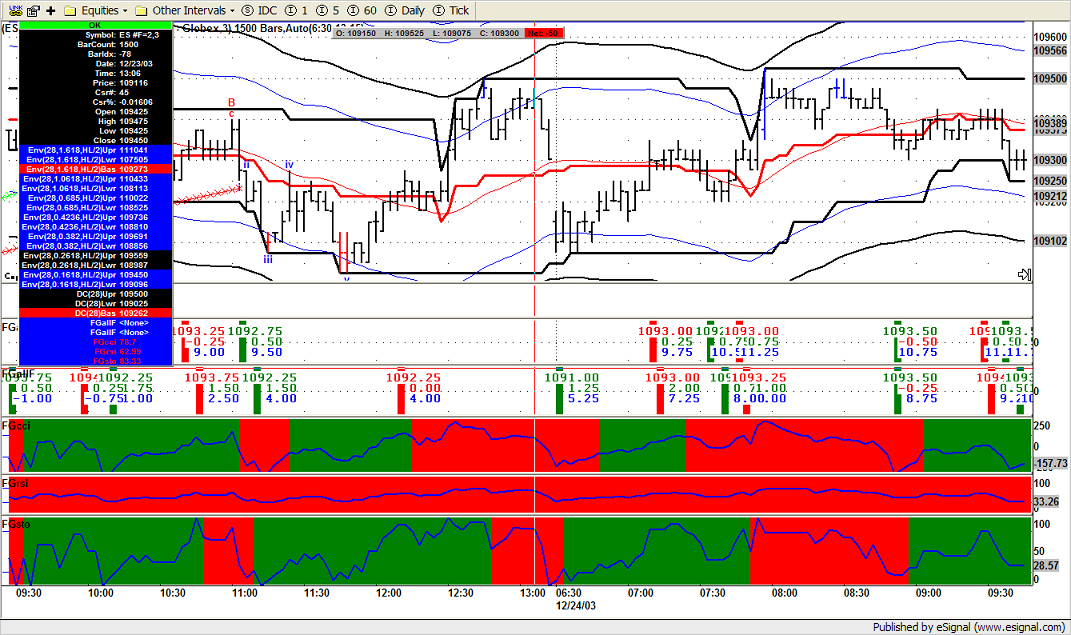

Lastly, the best results I have had so far across various periods seem to be using the contrarian with 28/14/16-1-3 respectively for CCI, RSI and Stoch.

Alex

Attached is the framework efs with the MAs of indicators each one with its own function parameters.

One note regarding the MAofStoch. Since there is a bug which does not allow to directly calculate the MA of StochStudy.SLOW I have implemented a workaround that essentially computes the MA of the MA of StochStudy.FAST.

At this point could you please transfer all the logic of the latest FGallFalse.efs to this one? I would still leave in both strategies ie the original OB/OS and the modified "contrarian" one.

Lastly, the best results I have had so far across various periods seem to be using the contrarian with 28/14/16-1-3 respectively for CCI, RSI and Stoch.

Alex

Comment