Hello All,

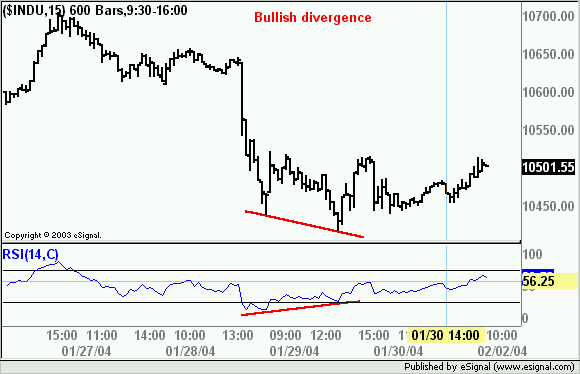

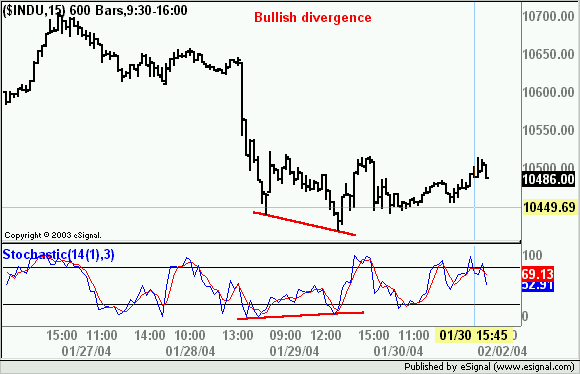

Can someone take a look at the attached image and let me know if this is actually a divergence. I don't think it is.

Cheers

Carlton

Can someone take a look at the attached image and let me know if this is actually a divergence. I don't think it is.

Cheers

Carlton

Comment