I'm also having a bit of trouble accessing an event from another symbol and if that event = true then DrawRelativeText/Shape/Icon on current chart when that event happens.

For example:

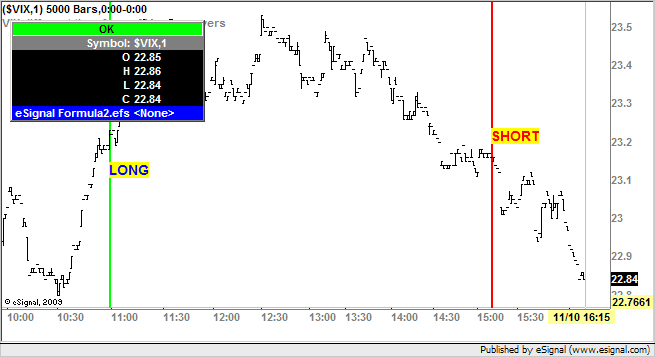

I want the EFS to post a "B" on the chart of the ES #F, when the close() of symbol = "$VIX" crosses below it's 50MA on a 1 min chart.

How do I write that in EFS? I cannot figure it out for the life of me and it's driving me crazy.

Thanks in advance.

Here is what I have currently:

//{{EFSWizard_Description

//

// This formula was generated by the Alert Wizard

//

//}}EFSWizard_Description

//{{EFSWizard_Declarations

var vEMA8 = new MAStudy(8, 0, "Close", MAStudy.EXPONENTIAL);

var vVWMA20 = new MAStudy(20, 0, "Close", MAStudy.VOLUMEWEIGHTED);

var vSMA50 = new MAStudy(50, 0, "Close", MAStudy.SIMPLE);

var vSMA200 = new MAStudy(200, 0, "Close", MAStudy.SIMPLE);

var vLastAlert = -1;

//}}EFSWizard_Declarations

function preMain() {

/**

* This function is called only once, before any of the bars are loaded.

* Place any study or EFS configuration commands here.

*/

//{{EFSWizard_PreMain

setPriceStudy(true);

setStudyTitle("8MA-20MA X 50MA CrossEDITOR");

setCursorLabelName("HIGH", 0);

setCursorLabelName("LOW", 1);

setDefaultBarStyle(PS_DASH, 0);

setDefaultBarStyle(PS_DASH, 1);

setDefaultBarFgColor(Color.black, 0);

setDefaultBarFgColor(Color.black, 1);

setDefaultBarThickness(3, 0);

setDefaultBarThickness(3, 1);

setPlotType(PLOTTYPE_LINE, 0);

setPlotType(PLOTTYPE_LINE, 1);

//}}EFSWizard_PreMain

}

function main() {

/**

* The main() function is called once per bar on all previous bars, once per

* each incoming completed bar, and if you don't have 'setComputeOnClose(true)'

* in your preMain(), it is also called on every tick.

*/

//{{EFSWizard_Expressions

//{{EFSWizard_Expression_1

if (

vSMA200.getValue(MAStudy.MA, -1) == null

) onAction1()

//}}EFSWizard_Expression_1

//{{EFSWizard_Expression_2

else if (

Strategy.isShort() == false &&

vEMA8.getValue(MAStudy.MA, 1) > vSMA50.getValue(MAStudy.MA, 1) &&

vVWMA20.getValue(MAStudy.MA, 1) >= vSMA50.getValue(MAStudy.MA, 1) &&

close(1, 5, "VIX") > vSMA50.getValue(MAStudy.MA, 1) &&

close() == vSMA200.getValue(MAStudy.MA, 1)

) onAction2()

//}}EFSWizard_Expression_2

//{{EFSWizard_Expression_3

else if (

vSMA200.getValue(MAStudy.MA, -1) == null

) onAction3()

//}}EFSWizard_Expression_3

//{{EFSWizard_Expression_4

else if (

Strategy.isLONG == false &&

vEMA8.getValue(MAStudy.MA, -1) < vSMA50.getValue(MAStudy.MA, -1) &&

vEMA8.getValue(MAStudy.MA) > vSMA50.getValue(MAStudy.MA) &&

vVWMA20.getValue(MAStudy.MA, 1) < vSMA50.getValue(MAStudy.MA, 1) &&

close(1, 5, "VIX") < vSMA50.getValue(MAStudy.MA, 1) &&

close() < vSMA200.getValue(MAStudy.MA, 1)

) onAction4();

//}}EFSWizard_Expression_4

//}}EFSWizard_Expressions

//{{EFSWizard_Return

return new Array(

high(),

low()

);

//}}EFSWizard_Return

}

function postMain() {

/**

* The postMain() function is called only once, when the EFS is no longer used for

* the current symbol (ie, symbol change, chart closing, or application shutdown).

*/

}

//{{EFSWizard_Actions

//{{EFSWizard_Action_1

function onAction1() {

vLastAlert = 1;

}

//}}EFSWizard_Action_1

//{{EFSWizard_Action_2

function onAction2() {

if (vLastAlert != 2) drawShapeRelative(0, high(), Shape.DOWNARROW, "", Color.RGB(255,0,0), Shape.TOP);

setBarBgColor(Color.RGB(0,128,0));

Strategy.doShort("GET SHORT", Strategy.CLOSE, Strategy.THISBAR, Strategy.DEFAULT, 0);

vLastAlert = 2;

}

//}}EFSWizard_Action_2

//{{EFSWizard_Action_3

function onAction3() {

vLastAlert = 3;

}

//}}EFSWizard_Action_3

//{{EFSWizard_Action_4

function onAction4() {

setBarBgColor(Color.RGB(0,128,0));

Strategy.doLong("GET LONG", Strategy.CLOSE, Strategy.THISBAR, Strategy.DEFAULT, 0);

if (vLastAlert != 4) drawShapeRelative(0, low(), Shape.UPARROW, "", Color.RGB(0,255,0), Shape.BOTTOM);

vLastAlert = 4;

}

//}}EFSWizard_Action_4

//}}EFSWizard_Actions

For example:

I want the EFS to post a "B" on the chart of the ES #F, when the close() of symbol = "$VIX" crosses below it's 50MA on a 1 min chart.

How do I write that in EFS? I cannot figure it out for the life of me and it's driving me crazy.

Thanks in advance.

Here is what I have currently:

//{{EFSWizard_Description

//

// This formula was generated by the Alert Wizard

//

//}}EFSWizard_Description

//{{EFSWizard_Declarations

var vEMA8 = new MAStudy(8, 0, "Close", MAStudy.EXPONENTIAL);

var vVWMA20 = new MAStudy(20, 0, "Close", MAStudy.VOLUMEWEIGHTED);

var vSMA50 = new MAStudy(50, 0, "Close", MAStudy.SIMPLE);

var vSMA200 = new MAStudy(200, 0, "Close", MAStudy.SIMPLE);

var vLastAlert = -1;

//}}EFSWizard_Declarations

function preMain() {

/**

* This function is called only once, before any of the bars are loaded.

* Place any study or EFS configuration commands here.

*/

//{{EFSWizard_PreMain

setPriceStudy(true);

setStudyTitle("8MA-20MA X 50MA CrossEDITOR");

setCursorLabelName("HIGH", 0);

setCursorLabelName("LOW", 1);

setDefaultBarStyle(PS_DASH, 0);

setDefaultBarStyle(PS_DASH, 1);

setDefaultBarFgColor(Color.black, 0);

setDefaultBarFgColor(Color.black, 1);

setDefaultBarThickness(3, 0);

setDefaultBarThickness(3, 1);

setPlotType(PLOTTYPE_LINE, 0);

setPlotType(PLOTTYPE_LINE, 1);

//}}EFSWizard_PreMain

}

function main() {

/**

* The main() function is called once per bar on all previous bars, once per

* each incoming completed bar, and if you don't have 'setComputeOnClose(true)'

* in your preMain(), it is also called on every tick.

*/

//{{EFSWizard_Expressions

//{{EFSWizard_Expression_1

if (

vSMA200.getValue(MAStudy.MA, -1) == null

) onAction1()

//}}EFSWizard_Expression_1

//{{EFSWizard_Expression_2

else if (

Strategy.isShort() == false &&

vEMA8.getValue(MAStudy.MA, 1) > vSMA50.getValue(MAStudy.MA, 1) &&

vVWMA20.getValue(MAStudy.MA, 1) >= vSMA50.getValue(MAStudy.MA, 1) &&

close(1, 5, "VIX") > vSMA50.getValue(MAStudy.MA, 1) &&

close() == vSMA200.getValue(MAStudy.MA, 1)

) onAction2()

//}}EFSWizard_Expression_2

//{{EFSWizard_Expression_3

else if (

vSMA200.getValue(MAStudy.MA, -1) == null

) onAction3()

//}}EFSWizard_Expression_3

//{{EFSWizard_Expression_4

else if (

Strategy.isLONG == false &&

vEMA8.getValue(MAStudy.MA, -1) < vSMA50.getValue(MAStudy.MA, -1) &&

vEMA8.getValue(MAStudy.MA) > vSMA50.getValue(MAStudy.MA) &&

vVWMA20.getValue(MAStudy.MA, 1) < vSMA50.getValue(MAStudy.MA, 1) &&

close(1, 5, "VIX") < vSMA50.getValue(MAStudy.MA, 1) &&

close() < vSMA200.getValue(MAStudy.MA, 1)

) onAction4();

//}}EFSWizard_Expression_4

//}}EFSWizard_Expressions

//{{EFSWizard_Return

return new Array(

high(),

low()

);

//}}EFSWizard_Return

}

function postMain() {

/**

* The postMain() function is called only once, when the EFS is no longer used for

* the current symbol (ie, symbol change, chart closing, or application shutdown).

*/

}

//{{EFSWizard_Actions

//{{EFSWizard_Action_1

function onAction1() {

vLastAlert = 1;

}

//}}EFSWizard_Action_1

//{{EFSWizard_Action_2

function onAction2() {

if (vLastAlert != 2) drawShapeRelative(0, high(), Shape.DOWNARROW, "", Color.RGB(255,0,0), Shape.TOP);

setBarBgColor(Color.RGB(0,128,0));

Strategy.doShort("GET SHORT", Strategy.CLOSE, Strategy.THISBAR, Strategy.DEFAULT, 0);

vLastAlert = 2;

}

//}}EFSWizard_Action_2

//{{EFSWizard_Action_3

function onAction3() {

vLastAlert = 3;

}

//}}EFSWizard_Action_3

//{{EFSWizard_Action_4

function onAction4() {

setBarBgColor(Color.RGB(0,128,0));

Strategy.doLong("GET LONG", Strategy.CLOSE, Strategy.THISBAR, Strategy.DEFAULT, 0);

if (vLastAlert != 4) drawShapeRelative(0, low(), Shape.UPARROW, "", Color.RGB(0,255,0), Shape.BOTTOM);

vLastAlert = 4;

}

//}}EFSWizard_Action_4

//}}EFSWizard_Actions

Comment