How can I access the %k and %d numbers in a new formula, made with Formula Wizard, that will use StochStudy?

Announcement

Collapse

No announcement yet.

Stochastics Formula Wizard

Collapse

X

-

Hello Alex,

1. The stochastic calculation results in two numbers, %k and %d. In the formula wizard process I want to be able to request as follows; 'if %k or %D is this or that value then do this or that action'. I want to be able to do this for past and present values.

2. I cannot find a .efs file for StochStudy.Fast or StochStudy.Slow so I have not been able to see what number is being generated in the Formula wizard.

Comment

-

mmorgan

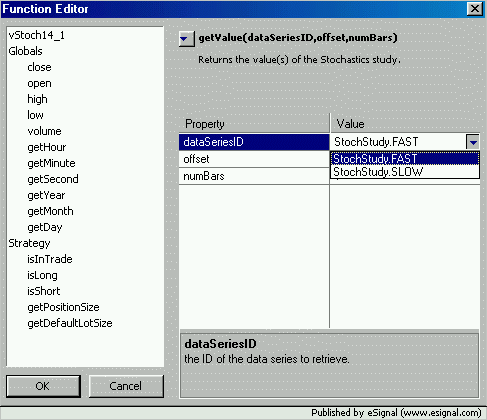

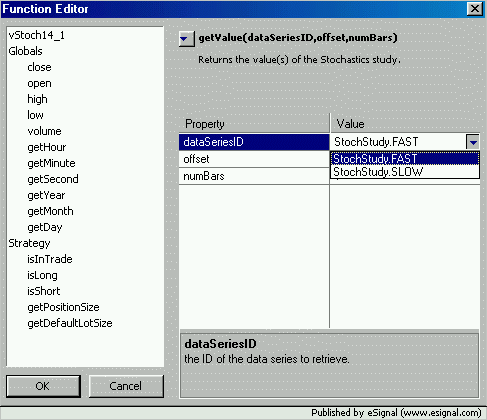

When you set the conditions in Formula Wizard (in Set1, Set2 etc) you select the Stochastic Study you created and it will open the Function Editor window where you can select which data series to use ie either FAST or SLOW from a dropdown list (see image below)

Alex

Comment

-

Alex,

I understand how to select either Fast or Slow in the drop down menu. But what are the numbers being calculated? I understand the difference between a fast stochastic and a slow one. When any stochastic is calculated the result is two numbers: %k and %d. Which of these numbers is the formula wizard using when it 'gets a value' called StochStudy.Fast or StochStudy.Slow?

I want to be able to manipulate both %K and %D for the Fast form and for the Slow form in a Formula Wizard equation. Can I do that?

Comment

-

Alex,Originally posted by Alexis C. Montenegro

mmorgan

When you set the conditions in Formula Wizard (in Set1, Set2 etc) you select the Stochastic Study you created and it will open the Function Editor window where you can select which data series to use ie either FAST or SLOW from a dropdown list (see image below)

Alex

Tech Support referred me to you and said you were the resident guru. Great! I would appreciate some assitance:

Could I get a copy of this Stoch Study mentioned above? I am looking for a basic slow stochastic study that I can use on Advanced Charts and vary the Price (open, close, high, or low), Period, %K slow period, and %D slow period and the Hi and Lo baseline. I would like to check this one out or any others that you could direct me to. I have already downloaded the ones in the file sharing -- Not what I wanted...

Thank you,

JR

Comment

-

JR

The Stochastic study that you reference in my message was created with the Formula Wizard and does not have the flexibility you are seeking.

What you really want is StochasticOf_Montage.efs which was written by JasonK and is truly the "Swiss Army Knife" of Stochastics

Alex

Comment

-

Thanks Alex!!!!! I'll check it out right now.Originally posted by Alexis C. Montenegro

JR

The Stochastic study that you reference in my message was created with the Formula Wizard and does not have the flexibility you are seeking.

What you really want is StochasticOf_Montage.efs which was written by JasonK and is truly the "Swiss Army Knife" of Stochastics

Alex

JR

Comment

-

Slow Stochastic - JasonK

Hi Alex,Originally posted by uphill

Thanks Alex!!!!! I'll check it out right now.

JR

I posted an inquiry to JasonK but have not got a reply. This study was really great but not set as a standard Slow Stochastic. I have to have it for Slow Stochastic. I am trying to duplicate exact charts from Intellichart and other systems I have. I want to bring it all over to eSignal.

Is there a better way to get in touch with JasonK?

Thanks for all the help.

JR

Comment

-

Hello JR,

For the slow stochastic, are you just trying to get a stochastic of stochastic? Have you seen this formula?Jason K.

Project Manager

eSignal - an Interactive Data company

EFS KnowledgeBase

JavaScript for EFS Video Series

EFS Beginner Tutorial Series

EFS Glossary

Custom EFS Development Policy

New User Orientation

Comment

-

Originally posted by JasonK

Hello JR,

For the slow stochastic, are you just trying to get a stochastic of stochastic? Have you seen this formula?

Hi Jason,

Thanks for the reply but the link did not work and I did not see a formula. Please resend link.

I am looking for a Slow Stochastic like this:

indicator Slow_Stochastics;

input price = close, period = 8, k_slow_period = 3, d_slow_period = 3, hi_baseline = 80, lo_baseline = 20;

draw line_k("Slow %K"), line_d("Slow %D"), line_hi("HI Base"), line_lo("LO Base");

vars k(series), i(number), lo(number), dif(number);

begin

line_hi := makeseries(front(close), back(close), hi_baseline);

line_lo := makeseries(front(close), back(close), lo_baseline);

for i := front(price) + period - 1 to back(price) do begin

lo := movmin(low, i, period);

dif := movmax(high, i, period) - lo;

if dif > 0 then

k[i] := 100 * (price[i] - lo) / dif

else

k[i] := 0;

end;

line_k := mma(k, k_slow_period);

line_d := mma(line_k, d_slow_period);

end.

Do you have something like this in efs? Or, can you translate it to efs for me? The above is in CTL language.

Thanks,

JR

Comment

Comment