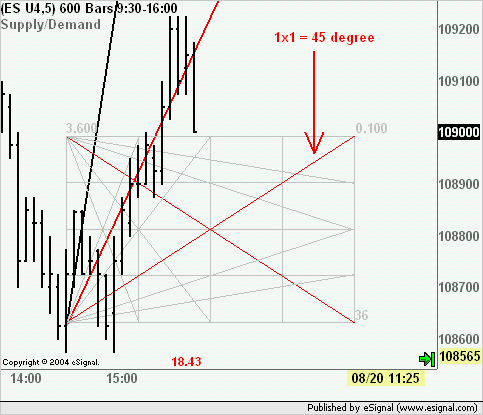

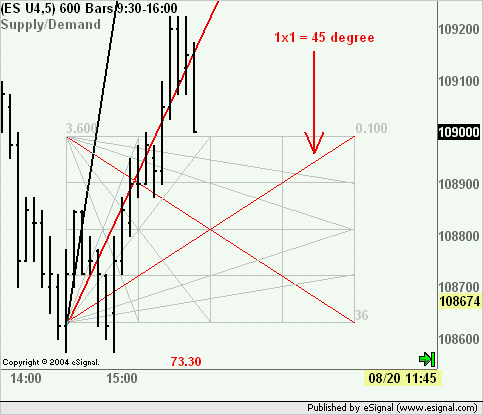

I need an intraday pricestudy that plots a extended (sloping) line connecting the opening price of only fully completed candles.

The study will draw two lines:

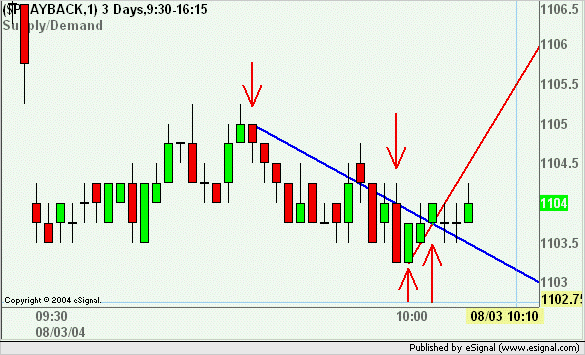

A supply Line:

connects highest downcandle with the last completed downcandle. If the highest downcandle is also the last downcandle, then only draw a horizontal line at this candle's opening price;

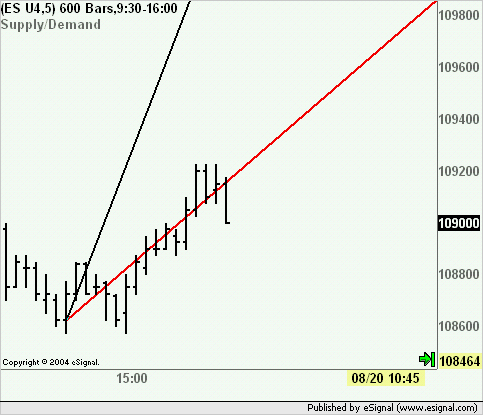

A demand line:

connects lowest upcandle with the last completed upcandle. If the lowest upcandle is also the last upcandle, then only draw a horizontal line at this candle's opening price;

Does anybody has this efs already? If not, can this be build easily? suggestions and advice on pitfalls is appreciated.

Sincere,

Clyde

The study will draw two lines:

A supply Line:

connects highest downcandle with the last completed downcandle. If the highest downcandle is also the last downcandle, then only draw a horizontal line at this candle's opening price;

A demand line:

connects lowest upcandle with the last completed upcandle. If the lowest upcandle is also the last upcandle, then only draw a horizontal line at this candle's opening price;

Does anybody has this efs already? If not, can this be build easily? suggestions and advice on pitfalls is appreciated.

Sincere,

Clyde

Comment