I know this subject doesn't interest too many traders in the Land of The Free, but we antipodeans pay the same for eSignal as everyone else (possibly more) and could really use some sympathetic help.

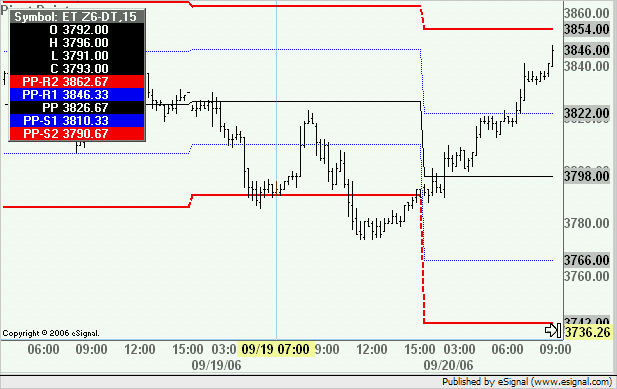

The Eurex Daily Settlement still gives a pivot calc problem because settlement is calculated at the underlying close of 17:30 local instead of at 22:00 when the futures market closes. (Please see attached chart of recent open of the DJ EuroSTOXX50).

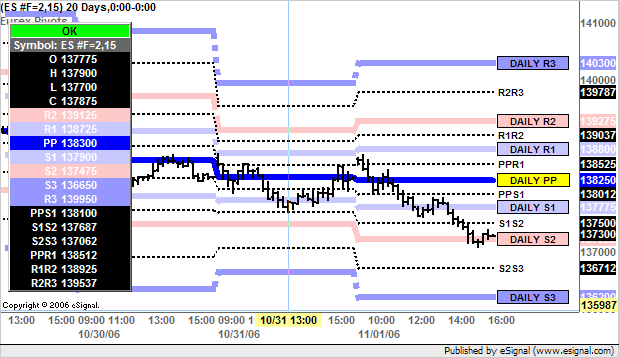

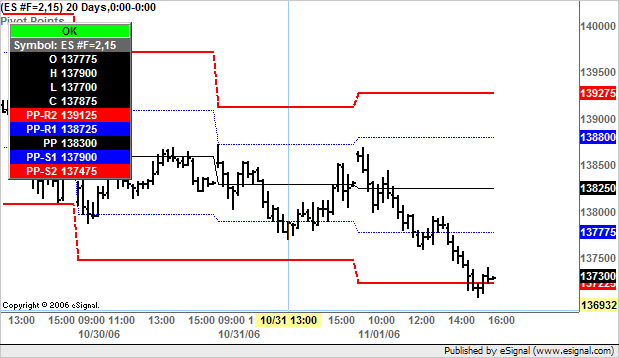

Derivate Check (see below) have the correct pivots because they are calculated from the ACTUAL close. Question is, how can I get EFS to make it's calc from the 22:00 close and not the 17:30 close?

Huge thanks in anticipation.

The Eurex Daily Settlement still gives a pivot calc problem because settlement is calculated at the underlying close of 17:30 local instead of at 22:00 when the futures market closes. (Please see attached chart of recent open of the DJ EuroSTOXX50).

Derivate Check (see below) have the correct pivots because they are calculated from the ACTUAL close. Question is, how can I get EFS to make it's calc from the 22:00 close and not the 17:30 close?

Huge thanks in anticipation.

Comment