Steve, Tony

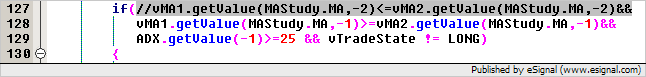

Given that the conditions are evaluated inside a BARSTATE_NEWBAR statement and that they reference the values of the indicators at the prior bar the more logical fill type constant to use is Strategy.MARKET [rather than Strategy.CLOSE] as it simulates the first tick after the conditions evaluate to true.

Alex

Given that the conditions are evaluated inside a BARSTATE_NEWBAR statement and that they reference the values of the indicators at the prior bar the more logical fill type constant to use is Strategy.MARKET [rather than Strategy.CLOSE] as it simulates the first tick after the conditions evaluate to true.

Alex

Comment