Compradun

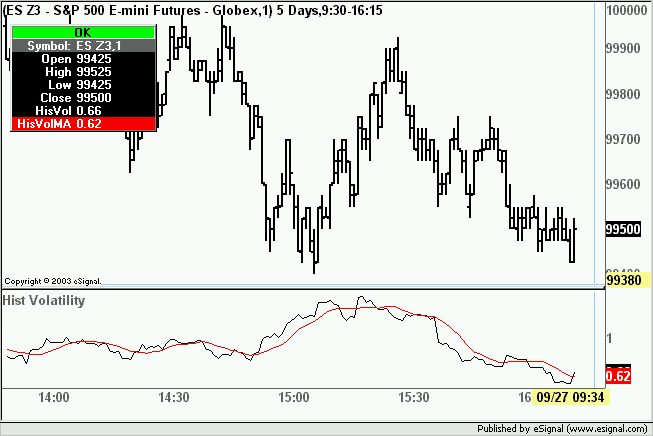

I think the attached efs does what you asked.

All modifications are commented in the efs itself. I am not absolutely positive the location of getBarState() in the formula is ideal

but I have run the efs on Tick Replay and as far as I can see I am not having any drift issues.

Alex

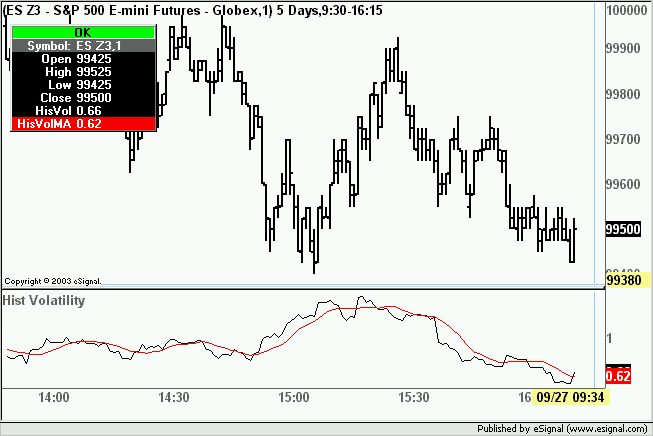

I think the attached efs does what you asked.

All modifications are commented in the efs itself. I am not absolutely positive the location of getBarState() in the formula is ideal

but I have run the efs on Tick Replay and as far as I can see I am not having any drift issues.

Alex

Great stuff.

Great stuff.

Comment